Loading

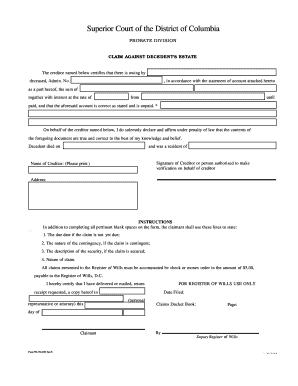

Get Estate Claim Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Estate Claim Form online

This guide provides clear and supportive instructions on how to correctly complete the Estate Claim Form online, ensuring that all requisite information is properly filled out. Following these steps will help you navigate the process with confidence and ease.

Follow the steps to complete the Estate Claim Form online.

- Press the ‘Get Form’ button to retrieve the Estate Claim Form and open it in your online editor.

- Start by entering the name of the deceased in the designated field. This identifies the individual whose estate you are claiming against.

- Fill in the Administration Number, which is typically assigned by the court. If unknown, consult relevant documents or court records.

- Declare the total amount owed by the deceased, including any amounts owed along with applicable interest. Include the interest rate and the time frame for calculation.

- Complete the declaration regarding the accuracy of the claim and your authority to submit it. Provide your signature, name, and address in the corresponding fields.

- If your claim is contingent, indicate the due date, nature of the contingency, and a description of any security related to the claim in the spaces provided.

- Ensure you attach a check or money order of $5.00 payable to the Register of Wills, D.C., along with your completed claim.

- Review all entries for accuracy and completeness, then save your changes. You can download or print the form, and if required, share it with relevant parties.

Complete your claims online efficiently by following these steps.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

A claim against an estate is a written request for the estate to pay money that the decedent owed. ... If you know that a person who owes you money has passed away, contact the probate court in the county where the decedent lived to learn whether an estate is being probated.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.