Loading

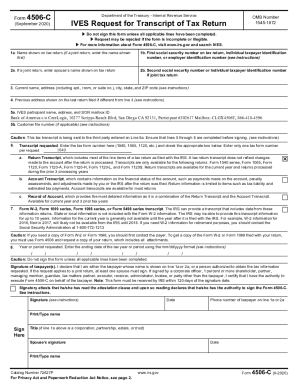

Get 4506 C Fillable Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the 4506 C Fillable Form online

Filling out the 4506 C Fillable Form online can be a straightforward process when guided properly. This form is essential for requesting a transcript of tax returns through authorized participants.

Follow the steps to effectively complete the 4506 C Fillable Form online.

- Press the ‘Get Form’ button to acquire the form and open it in your preferred online editor.

- In line 1a, enter the name shown on your tax return. If filing jointly, include the first person's name.

- In line 1b, input the first social security number or individual taxpayer identification number from the tax return.

- For joint returns, enter your spouse’s name in line 2a and their social security number in line 2b.

- On line 3, fill in your current name and full address, including any apartment or suite numbers.

- If your previous address differs from your current address, document this in line 4.

- In line 5a, specify the IVES participant's name and address where the transcript will be sent.

- If applicable, provide your unique customer file number in line 5b.

- In line 6, select the type of transcript requested. Check appropriate boxes for options such as return transcript, account transcript, or record of account.

- In line 8, indicate the ending date of the tax year or period you are requesting, following the mm/dd/yyyy format.

- Before signing, ensure all relevant lines have been completed, particularly lines 5a through 8.

- Sign and date the form. If filing jointly, at least one spouse must sign. Also, fill in the phone number and printed name.

- Finally, save your changes, then download, print, or share the completed form as needed.

Complete your forms online today for efficient document management.

Related links form

Completed tax transcripts usually are received within 24 48 hours or less but the IRS has up to 48 hours to process the request according to their guidelines for bulk vendors. Be wary of vendors who can promise 8 hour turn times as that is not part of the IRS program guidelines for processing 4506-T tax transcripts.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.