Loading

Get Formulaire T1036

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Formulaire T1036 online

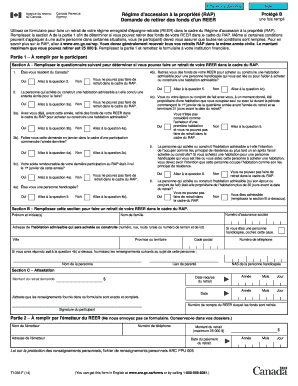

The Formulaire T1036 is a crucial document for individuals looking to withdraw funds from their registered retirement savings plan in relation to the Home Buyers' Plan. This guide offers a step-by-step approach to assist users in completing this form online.

Follow the steps to successfully complete the Formulaire T1036 online.

- Click ‘Get Form’ button to obtain the form and open it for editing.

- Begin with Part 1, Section A of the form. Answer the questionnaire to determine your eligibility to withdraw funds under the Home Buyers' Plan. Ensure you complete all necessary parts as not all conditions may apply to everyone.

- In Section A, question 1 asks if you are withdrawing funds to purchase or construct a home for a person with a disability related to you. Answer 'Yes' or 'No' and proceed accordingly based on your answer.

- Continue answering the questions in Section A to ascertain your eligibility. If you respond 'No' at any point when the form indicates, you will be informed that you cannot withdraw funds under this plan.

- Once you confirm eligibility through Section A, proceed to Section B. Here, provide your personal details, including first name, initial(s), last name, social insurance number, and address of the property involved.

- If applicable, provide details about the person with a disability, including their name, relationship to you, and social insurance number in Section B.

- Complete Section C by providing a date, the amount requested for withdrawal (maximum $25,000), and the number of the account from which the funds will be withdrawn.

- Finally, sign the form to attest that the information provided is accurate and complete, after which you can save your changes, download, print, or share the completed form as needed.

Complete your Formulaire T1036 online today to make your withdrawal process smoother.

If your spouse doesn't contribute to an RRSP, starting a plan in his or her name can double your downpayment for your first home. The Home Buyers' Plan (HBP) lets you withdraw up to $35,000 from your RRSP with no penalties, and you can add up to $35,000 from your spouse's RRSP to your downpayment.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.