Loading

Get C4c - Continuation Page For Form C4

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the C4C - Continuation Page For Form C4 online

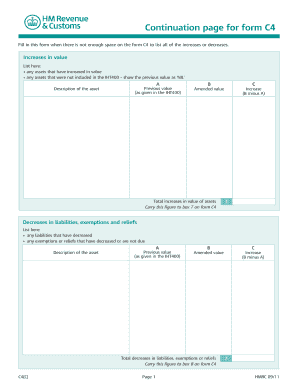

Filling out the C4C - Continuation Page for Form C4 is essential when additional space is needed to detail asset changes and value adjustments. This guide provides clear, step-by-step instructions tailored to assist users in completing this form accurately and efficiently online.

Follow the steps to successfully fill out the C4C - Continuation Page for Form C4.

- Click ‘Get Form’ button to obtain the C4C - Continuation Page and open it in your preferred online editing tool.

- In this section, list any increases in asset values. For each asset, provide a description, the previous value as recorded in Form IHT400, and the amended value. Calculate any increase by subtracting the previous value from the amended one.

- Next, detail any decreases in liabilities, exemptions, and reliefs. Similar to the previous step, include a description, the previous value, and calculate the total decrease.

- For any assets that have experienced a decrease in value, record them here. Enter the asset description, previous value, amended value, and calculate the decrease.

- Finally, list any increases in liabilities, exemptions, and reliefs. Document the previous value and the amended value, then calculate the increase.

- After filling in all the necessary information, review the entries for accuracy. Once confirmed, you can save the changes, download, print, or share the completed form as needed.

Complete your C4C - Continuation Page for Form C4 online today!

Form C4 is a corrective account. Taxpayers or agents complete this form to tell us of amendments to the original account. Strictly speaking, they are required to deliver a corrective account (IHTM10805) within 6 months of discovering that the original account was incorrect.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.