Loading

Get Mortgage Satisfaction Letter Template

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Mortgage Satisfaction Letter Template online

Completing a Mortgage Satisfaction Letter is an important step in confirming that a mortgage has been fully paid and is no longer in effect. This guide provides clear, user-friendly instructions to help you navigate the process of filling out the Mortgage Satisfaction Letter Template online.

Follow the steps to efficiently complete the Mortgage Satisfaction Letter Template

- Click ‘Get Form’ button to obtain the form and open it in the editor.

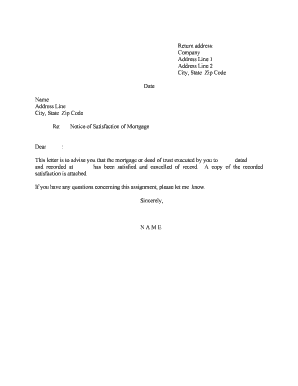

- Fill in the return address section with your company name and address details, ensuring that each line of the address is complete and correctly formatted.

- Enter the date on which you are completing the letter. This is important for record-keeping and legal purposes.

- In the recipient's section, input the name and address of the borrower or the person to whom you are sending the letter.

- In the ‘Re’ field, specify the subject of the letter, which is typically mentioned as the mortgage or deed of trust.

- Begin the body of the letter with a greeting, addressing the recipient appropriately.

- Clearly state that the mortgage or deed of trust has been satisfied and cancelled of record. Include the specific date the mortgage was executed and the record details as required.

- Attach a copy of the recorded satisfaction to the letter as documentation.

- Conclude the letter with an offer for further assistance and include your name and relevant contact information.

- After completing the form, remember to save changes, download the document, and print or share as needed.

Start completing your documents online today for efficient management and peace of mind.

In order to clear the title to the real property owned by the mortgagor, the Satisfaction of Mortgage document must be recorded with the County Recorder or Recorder of Deeds. If the mortgagee fails to record a satisfaction within the set time limits, the mortgagee may be responsible for damages set out by statute.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.