Loading

Get 1299 Form 8867. Paid Preparer's Earned Income Credit Checklist

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 1299 Form 8867. Paid Preparer's Earned Income Credit Checklist online

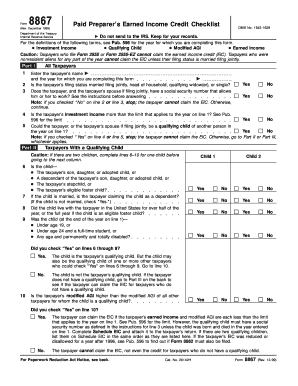

The 1299 Form 8867, also known as the Paid Preparer's Earned Income Credit Checklist, is essential for tax preparers to verify eligibility for the earned income credit (EIC). This guide will provide you with clear, step-by-step instructions on how to complete the form online.

Follow the steps to accurately complete the 1299 Form 8867.

- Click the ‘Get Form’ button to obtain the 1299 Form 8867 and open it in your chosen digital editor.

- Start by entering the taxpayer’s name and the relevant tax year in the appropriate fields at the top of the form.

- Indicate the taxpayer’s filing status by selecting from the options provided: married filing jointly, head of household, qualifying widow(er), or single.

- Confirm that the taxpayer and their spouse (if applicable) hold a valid social security number that permits them to work. If either does not, the taxpayer is not eligible for the EIC.

- Check if the taxpayer’s investment income exceeds the threshold specified in the accompanying publication. If it does, the taxpayer cannot claim the EIC.

- Assess if the taxpayer, or their spouse if filing jointly, could be classified as a qualifying child of another taxpayer. If so, they do not qualify for the EIC.

- If the taxpayer has a qualifying child, fill out the details related to that child, ensuring to verify their living arrangements, age, and relationship to the taxpayer.

- If there are multiple qualifying children, complete the fields for one child at a time before moving to the next.

- For taxpayers without a qualifying child, confirm their residence, age, and dependency status as outlined in Part III of the form.

- Lastly, review all entries for accuracy, then save your changes. You can then download, print, or share the completed form as needed.

Complete your 1299 Form 8867 online today to ensure accurate tax preparation!

Form 8867, Paid Preparer's Due Diligence Checklist, must be filed with the tax return for any taxpayer claiming EIC, the CTC/ACTC, and/or the AOTC.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.