Loading

Get Stf Ex10025f

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the STF EX10025F online

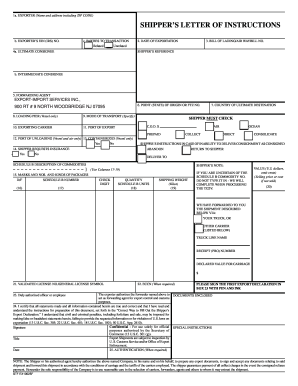

Filling out the STF EX10025F properly is crucial for the successful handling of export shipments. This guide provides clear instructions to help you complete the form online, ensuring compliance with export regulations and smooth processing.

Follow the steps to fill out the STF EX10025F online.

- Click the ‘Get Form’ button to access the STF EX10025F online and open it in the relevant application.

- Begin by entering the exporter’s name and address in the designated fields, including the ZIP Code. Make sure all details are accurate and complete.

- Provide the exporter’s Employer Identification Number (EIN) as issued by the IRS in the specified section.

- Indicate whether the parties to the transaction are related or unrelated by selecting the appropriate option.

- Fill in the ultimate consignee's information in section 4, ensuring accuracy in both name and address.

- Record the date of exportation in section 2, using the correct format to avoid processing delays.

- Input the bill of lading or air waybill number in section 3 clearly to facilitate tracking.

- Provide the shipper’s reference number if applicable, which helps in the identification of the shipment.

- Complete the intermediate consignee's details in section 5, if necessary.

- Insert information for the forwarding agent, noting that Export-Import Services Inc. is stated in the example.

- Specify the point of origin or Foreign Trade Zone (FTZ) number in section 6.

- If applicable, complete details regarding the loading pier for vessels.

- Specify the mode of transport in section 9; choose between options like ocean or air transport.

- Provide details about the exporting carrier in section 10, along with the port of export.

- Fill in the port of unloading section, marking it clearly for vessels and air transport.

- Indicate if the cargo is containerized by selecting yes or no.

- Mark C.O.D. if applicable, and fill in the delivery instructions as needed.

- Incorporate the Schedule B number and description of commodities with care, following guidelines closely.

- Specify the quantity and shipping weight in the designated areas, ensuring all figures are precise.

- Enter the value in U.S. dollars, ensuring to omit cents for clarity.

- Sign section 23 with a pen and ink, certifying that the information is correct and you understand the legal implications.

- Ensure all necessary attachments are included before finalizing the form.

- After reviewing the completed form, save changes, and choose to download, print, or share the form as required.

Start completing your STF EX10025F online today to ensure proper export documentation.

To open STF files, you need compatible software that recognizes the format, such as specific tax preparation software. If you do not have the necessary tools installed, consider downloading the required applications or accessing online tools that support STF files. If you need assistance, check resources available on uslegalforms to guide you through working with STF EX10025F efficiently.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.