Loading

Get Paydata Employee Set Up Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the PayData Employee Set Up Form online

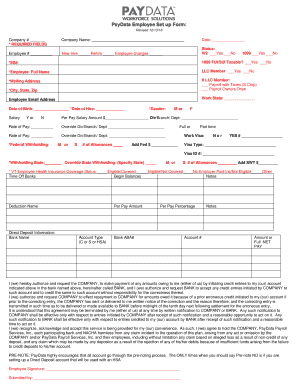

The PayData Employee Set Up Form is an essential document for onboarding new employees and updating existing employee information. This guide provides a detailed overview of how to effectively complete the form online, ensuring that all necessary information is accurately captured.

Follow the steps to complete the form accurately and efficiently.

- Click ‘Get Form’ button to obtain the form and open it in your preferred editor.

- Begin by entering the company number in the designated field. This number is essential for identifying your organization in the system.

- Fill in the company name as it appears in official documents.

- Write the date on which you are completing the form.

- Enter the employee number, which is typically assigned by your company.

- Indicate whether this entry is for a new hire, rehire, or employee changes by selecting the appropriate checkbox.

- Specify the employment status: W2 or 1099, and answer whether the employee will receive W2 or 1099 forms.

- Input the employee’s Social Security number in the required field, ensuring accuracy for tax purposes.

- For 1099 employees, indicate if they are subject to FUI/SUI taxes by selecting 'Yes' or 'No'.

- Enter the full name of the employee in the corresponding field.

- If the employee is an LLC member, specify their tax payroll type as either payroll with taxes or owner's draw.

- Provide the mailing address, including city, state, and zip code for reliable communication.

- Enter the employee's email address, ensuring it is valid for future correspondence.

- Fill in the work state where the employee will be performing their job responsibilities.

- Provide the employee's date of birth and date of hire in the required format.

- Input the salary and indicate if it is a salary for per pay period.

- Specify the gender of the employee using the designated options provided.

- Fill out federal withholding information, including marital status and allowances.

- Indicate if the employee is full-time or part-time.

- If applicable, provide details about the employee’s work visa, including visa type and number.

- Fill in the state withholding information and specify any overrides if necessary.

- Complete the employee health insurance coverage status as it applies to the employee.

- In the direct deposit section, provide the bank name and account details, including account type and ABA number.

- Authorize the payment agreement by reading the terms and providing your signature in the designated area.

- Review all entries for accuracy before finalizing your submission.

- Save changes, download, print, or share the completed form as needed.

Complete your PayData Employee Set Up Form online today to ensure efficient processing of employee information.

How to process payroll yourself Step 1: Have all employees complete a W-4 form. ... Step 2: Find or sign up for Employer Identification Numbers. ... Step 3: Choose your payroll schedule. ... Step 4: Calculate and withhold income taxes. ... Step 5: Pay payroll taxes. ... Step 6: File tax forms & employee W-2s.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.