Loading

Get Fw8bene

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Fw8bene online

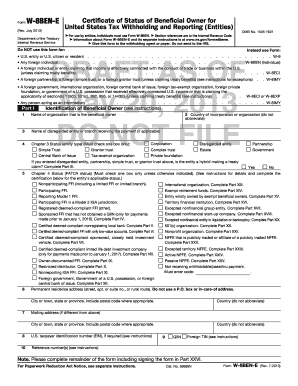

Completing the Fw8bene form can be essential for entities seeking to certify their status as beneficial owners for U.S. tax purposes. This guide provides a clear, step-by-step approach to help users navigate the form efficiently.

Follow the steps to successfully complete the Fw8bene form online.

- Press the ‘Get Form’ button to acquire the form and open it in your preferred online environment.

- In Part I, indicate the name of the organization that is the beneficial owner, the country of incorporation, and state the chapter 3 and chapter 4 statuses by checking the appropriate boxes.

- For any disregarded entity or branch receiving payment, complete Part II with the relevant chapter 4 status.

- If claiming tax treaty benefits, fill out Part III by checking applicable boxes and providing necessary explanations.

- Proceed to complete any relevant sections from Parts IV through XXV based on your entity’s specific circumstances.

- Once all sections are complete, review the entire form for accuracy.

- Save the changes, download a copy of the filled form, print it if necessary, or prepare to share it with the withholding agent.

Complete the Fw8bene form online to ensure proper tax certification for your entity.

Form W-8BEN ("Certificate of Foreign Status of Beneficial Owner for United States Tax Withholding and Reporting") must be submitted by foreign persons who receive certain types of income in the United States.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.