Loading

Get Borrowing Base Template

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Borrowing Base Template online

Filling out the Borrowing Base Template online is an essential process for accurately assessing your borrowing capacity. This guide will provide you with a clear, step-by-step approach to complete the template effectively.

Follow the steps to complete the Borrowing Base Template online.

- Click ‘Get Form’ button to obtain the Borrowing Base Template and open it in the editor.

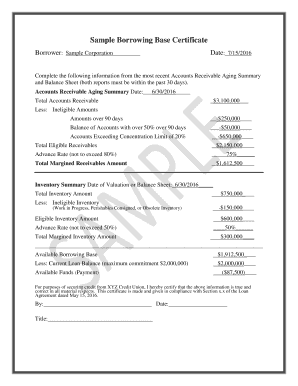

- Enter the borrower’s name in the designated field. This should reflect the legal name of the entity seeking to secure credit, such as 'Sample Corporation'.

- Input the date of completion in the appropriate section. Ensure that this date is current and reflects the day you are filling out the template.

- Refer to your most recent Accounts Receivable Aging Summary and enter the date of this report. This report must be within the last 30 days for accuracy.

- Fill in the total accounts receivable amount. This figure should reflect your total outstanding invoices or amounts owed to you.

- Deduct any ineligible amounts in the provided spaces. This includes amounts over 90 days, any balance of accounts with more than 50% overdue, and any accounts exceeding the concentration limit of 20%.

- Calculate and enter the total eligible receivables. Ensure the advance rate does not exceed 80%, and calculate the total margined receivables accordingly.

- Next, complete the inventory summary starting with the date of valuation or balance sheet. This should also be within the last 30 days.

- Input the total inventory amount and any ineligible inventory amounts (such as work in progress or obsolete inventory).

- Calculate the eligible inventory amount and enter it in the designated field. Ensure the advance rate here does not exceed 50%, and then calculate the total margined inventory amount.

- Now, calculate and enter the available borrowing base by aggregating the total eligible receivables and inventory amounts and deducting the current loan balance.

- Lastly, certify the accuracy of the information provided by signing and dating the certificate in the designated areas. Include your title as well.

- Once you have completed all sections, save your changes. You may then proceed to download, print, or share the Borrowing Base Template as needed.

Complete your Borrowing Base Template online today to ensure your financial assessments are accurate and up-to-date.

Borrowing Base Availability means the excess, if any, of the Borrowing Base over the sum of the Revolving Advances and the Letter of Credit Exposure.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.