Loading

Get Substitute Irs Form W-8ben-e

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Substitute IRS Form W-8BEN-E online

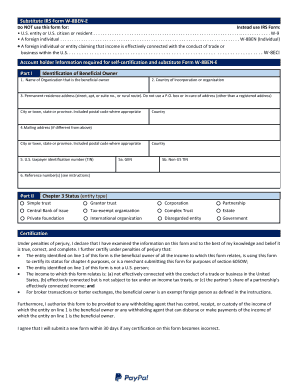

Filing the Substitute IRS Form W-8BEN-E can be a critical step for foreign entities to certify their status for withholding tax purposes. This guide provides a clear, step-by-step approach to help you successfully fill out the form online.

Follow the steps to complete the form accurately and efficiently.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- In Part I, enter the name of the organization that is the beneficial owner. Ensure the name matches official documents.

- Provide the full name of the entity that holds the account, avoiding abbreviations.

- Indicate the country of incorporation or organization. Avoid using abbreviations. Write the full country name.

- This should be the country under whose laws the entity is created.

- Fill in the permanent residence address. Ensure it does not contain a P.O. box unless it is your registered address.

- Include the street, city, state or province, postal code, and country.

- Complete the mailing address if it differs from the permanent residence address.

- If using a U.S. address, additional documentation may be required.

- Enter the U.S. Taxpayer Identification Number (TIN) if applicable, otherwise skip this section.

- Provide the format like 123-45-6789 if available.

- Specify the Global Intermediary Identification Number (GIIN) if the entity is a financial institution.

- Ensure it is formatted correctly, following the 19-character requirement.

- Select the appropriate Chapter 3 Status by checking only one box that reflects the entity type.

- Review the list and ensure to check only one option.

- Complete the self-certification for FATCA purposes, providing necessary details depending on your entity status.

- Ensure that only one box is checked under the self-certification sections.

- If applicable, provide information for any substantial U.S. owners and controlling persons.

- List their names, addresses, and TINs carefully.

- Sign the form. Make sure to print your name and the date beside your signature.

- All sections of the declaration should remain unaltered while providing the necessary signature.

- Save your changes, then download, print, or share the completed form as necessary.

Take the next step in managing your taxes by completing the Substitute IRS Form W-8BEN-E online today.

As a Canadian contractor earning income from a U.S. source, you are required to submit a properly completed Form W-8BEN to the party or company that is providing you with income. The form includes a declaration that you'll include this U.S. income on your Canadian tax return.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.