Loading

Get W2 Coloradopdffillercom Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the W2 Coloradopdffillercom Form online

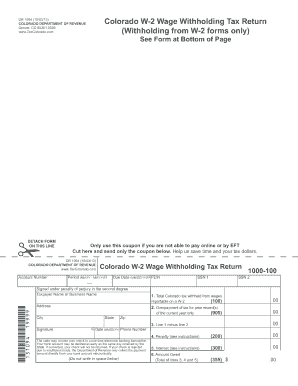

Filling out the W2 Coloradopdffillercom Form correctly is essential for reporting income taxes withheld from employee wages in Colorado. This guide provides clear, step-by-step instructions to ensure that you complete the form accurately and efficiently online.

Follow the steps to fill out the W2 Coloradopdffillercom Form online.

- Click the ‘Get Form’ button to access the W2 Coloradopdffillercom Form and open it in your preferred editor.

- Enter your Colorado business account number in the designated field. This number is an eight-digit identifier from your withholding certificate or sales tax license.

- Indicate the filing period for your return by entering the start and end dates in the MM/YY format.

- Provide the due date for submitting this return by entering it in the MM/DD/YY format.

- In Line 1, enter the total amount of Colorado income tax withheld from wages during the specified period.

- If applicable, complete Line 2 to report any overpayment of tax from prior periods by calculating the amount using the worksheet provided.

- Calculate the net amount due by subtracting the amount in Line 2 from the amount in Line 1, and enter this figure in Line 3.

- If you are filing after the due date, complete Line 4 by calculating any penalties that may apply. Refer to the provided instructions for the penalty rate.

- For any late interest owed, fill in Line 5 with the calculated interest amount based on the guidelines provided.

- Add the totals from Lines 3, 4, and 5, and record this total in Line 6 as the amount owed.

- Once you have completed the form, save your changes, and choose to download, print, or share the form as necessary.

Complete your documents online for a smoother filing experience.

If current or former employees do not have EPP access, they should contact their current or former Servicing Personnel Office (SPO) to request W-2 and W-2C reprints. The W-2 is available under Personal Info on the EPP left-hand menu.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.