Loading

Get Monthly Documentary Stamp

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Monthly Documentary Stamp online

This guide is designed to assist users in accurately filling out the Monthly Documentary Stamp form online. By following the step-by-step instructions provided, users can ensure they complete the document correctly and submit it with confidence.

Follow the steps to complete the Monthly Documentary Stamp form online

- Press the ‘Get Form’ button to access the Monthly Documentary Stamp form and open it for editing.

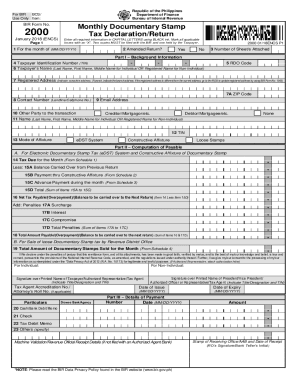

- Begin by entering the month for which you are filing in the specified MM/DD/YYYY format.

- Indicate if this is an amended return by marking the appropriate box with an ‘X’ for either 'Yes' or 'No'.

- Fill in the number of sheets attached to your form.

- In Part I, provide your Taxpayer Identification Number (TIN) in the designated field.

- Enter your name or registered business name as required.

- Complete your registered address fully, including branch details if applicable.

- Add the ZIP code for your registered address.

- Input your contact number, ensuring it is valid.

- Supply your email address for correspondence purposes.

- Specify the other party involved in the transaction by selecting from the options given.

- Provide the name and TIN of the other party involved in the transaction if applicable.

- Choose the mode of affixture appropriate for your situation.

- In Part II, calculate your tax due for the month and detail any previously carried over balances or payments.

- List any penalties that apply as well as the total amount payable.

- Complete any necessary schedules for clarity on taxes due.

- Review all entries for accuracy and correctness before finalizing.

- Save your changes, download, print, or share the form as needed.

Complete your Monthly Documentary Stamp form online to ensure timely and accurate submissions.

Related links form

The tax is paid by the person making, signing, issuing, accepting or transferring the documents. However, whenever one party to the taxable document enjoys exemption from the tax, the other party thereto who is not exempt shall be the one directly liable for the tax.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.