Loading

Get Certified Payroll Instructions F04.doc. Esa/whd Form Wh-347 - Source Nycsca

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the Certified Payroll Instructions F04.doc. ESA/WHD Form WH-347 - Source Nycsca online

Filling out the Certified Payroll Instructions F04.doc. ESA/WHD Form WH-347 is essential for ensuring compliance with payment requests in construction contracts. This guide provides clear, step-by-step instructions for successfully completing the form online.

Follow the steps to fill out the Certified Payroll Form accurately.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

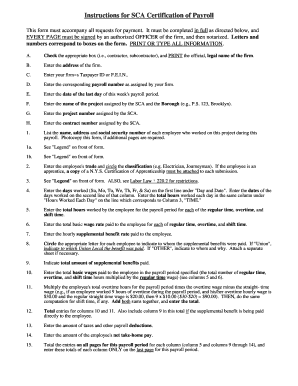

- Begin by checking the appropriate box to indicate whether you are a contractor or subcontractor. PRINT the official legal name of your firm in the designated field.

- Enter the address of your firm in the corresponding box.

- Provide your firm’s Taxpayer ID or Federal Employer Identification Number (F.E.I.N.) in the specified section.

- Input the payroll number assigned by your firm in the designated area.

- Fill in the date of the last day of the current payroll period in the appropriate field.

- Enter the project name assigned by the SCA along with the Borough (e.g., P.S. 123, Brooklyn) in the designated section.

- Record the project number assigned by the SCA in the corresponding box.

- Enter the contract number assigned by the SCA in the appropriate field.

- List the name, address, and social security number of each employee who worked on the project during this payroll period. If needed, photocopy the form for additional pages.

- For each employee, enter their trade and circle the classification (e.g., Electrician, Journeyman). If the employee is an apprentice, ensure to attach a copy of the New York State Certification of Apprenticeship with the submission.

- Enter the days worked during the payroll period, indicating each day of the week, followed by the corresponding total hours worked each day.

- Provide the total hours worked by each employee, breaking it down into regular, overtime, and shift time.

- Fill in the total basic wage rate paid to each employee for regular time, overtime, and shift time.

- Input the hourly supplemental benefit rate paid to the employee.

- Circle the appropriate letter indicating to whom the supplemental benefits were paid, detailing any specific notes as necessary.

- Indicate the total amount of supplemental benefits paid to the employee.

- Calculate and enter the total basic wages paid to the employee over the specified payroll period.

- Determine the total additional amounts for overtime and shift time, and enter this computation into the form.

- Total your entries from previous calculations. Include supplemental benefits if applicable.

- Record the amount of taxes and other payroll deductions that have been applied.

- Specify the net take-home pay for each employee.

- Finally, total the entries across all pages for each column, ensuring totals are recorded ONLY on the last page for clarity.

- After completing the form, save your changes, download the form for your records, print a copy, or share it as needed.

Complete your Certified Payroll Forms online to ensure compliance with SCA requirements.

Related links form

Type the word "Final" when the last payroll is submitted for the project. The last day of the payroll period. The name and location of project. The prime contractor should include the project number as listed in the loan Indicate the days and dates of the pay period.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.