Loading

Get Fin 418

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Fin 418 online

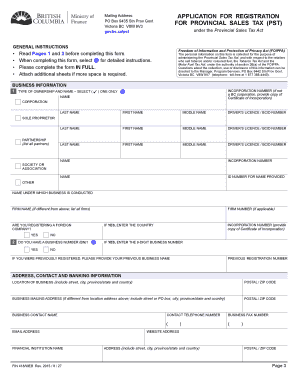

Filling out the Fin 418 form for Provincial Sales Tax registration is an important step for businesses operating in British Columbia. This guide will offer clear and supportive instructions to help you complete the form efficiently and accurately.

Follow the steps to successfully complete the Fin 418 form.

- Press the ‘Get Form’ button to access the Fin 418 form and open it in your preferred document editor.

- Review the form carefully and ensure you understand the requirements outlined in the general instructions. Provide all necessary information and documentation to avoid processing delays.

- In Item 1, select the type of ownership for your business and enter the full legal names as required. If applicable, attach a separate page for all partners in a partnership.

- In Item 2, provide your Business Number (BN). If you do not have one, select 'no,' and the ministry will obtain one for you.

- In Item 3, confirm if you are purchasing business assets and provide the necessary details of those assets.

- Item 4 requires you to describe your business type, primary nature, and any taxable sales or services you will provide in BC.

- For Item 5, indicate if you are a direct seller and describe your distribution methods, if applicable.

- In Item 6, specify the total number of accommodation units available to the public if you offer accommodation services.

- For Item 7, indicate if you will sell software or telecommunication services and provide additional details.

- In Item 8, if applicable, attach required documentation related to liquor sales, including purchase agreements and agreements for operating businesses.

- Provide your Motor Dealer Number in Item 9 if you sell or lease motor vehicles.

- In Item 10, confirm if you are selling tobacco products and state whether you have a valid Tobacco Retail Authorization (TRA) certificate.

- If you have multiple business locations in BC, complete Item 11 for each location, and submit a separate application for each.

- Finally, complete Item 12 to provide your total annual Canadian sales and your estimated monthly taxable sales in BC.

- Ensure you review your application for completeness and accuracy. You can then save changes, download, print, or share the form as needed.

Take the next step and complete your registration by filling out the Fin 418 online today.

Listening to podcasts and reading books about specific areas of finance that interest you help break down more complex financial topics and speed up the learning process. There are also many paid and free courses out there that offer courses in different areas of finance and investing.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.