Get Lifesecure Beneficiary Change Form 1999

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the LifeSecure Beneficiary Change Form online

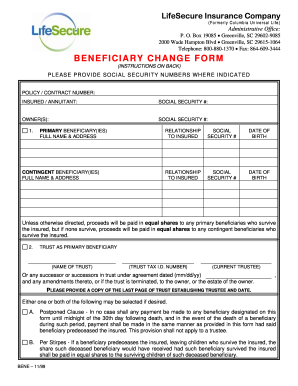

Filling out the LifeSecure Beneficiary Change Form online is an important step to ensure your beneficiaries are accurately designated. This guide will provide you with a clear and comprehensive step-by-step process to complete the form effectively.

Follow the steps to successfully complete the LifeSecure Beneficiary Change Form.

- Press the ‘Get Form’ button to access the form and open it in your preferred editor.

- Enter the policy or contract number and the name of the insured or annuitant, along with their social security number in the designated fields.

- List the owner(s) of the policy, providing their names and social security numbers as requested.

- In section one, provide the full name and address of each primary beneficiary. Include their relationship to the insured, social security number, and date of birth.

- Next, detail the contingent beneficiary(ies) by filling in their full name and address, along with their relationship to the insured, social security number, and date of birth.

- If designating a trust as a primary beneficiary, enter the name of the trust, trust tax identification number, and current trustee's name.

- Choose between the postponed clause or per stirpes provision if desired, following the instructions provided on the form.

- Sign and date the form. Ensure that your signature is witnessed by someone who is not related to you or a beneficiary.

- If you are an assignee or irrevocable beneficiary, include your signature as well.

- Once you have completed the form, review all entries for accuracy. Save your changes, and download or print the completed form for your records.

Complete your beneficiary change form online today for accurate and timely updates.

Get form

Once a beneficiary has passed away, you will need to submit a new LifeSecure Beneficiary Change Form to designate a new beneficiary. It’s important to review the policy to determine if there are any specific protocols to follow during this process. Consider reaching out to your insurance provider or legal representative for assistance in properly navigating this transition. Timely updates can help avoid complications in the future.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.