Loading

Get Formulaire 2031-sd - Impots.gouv

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Formulaire 2031-SD - Impots.gouv online

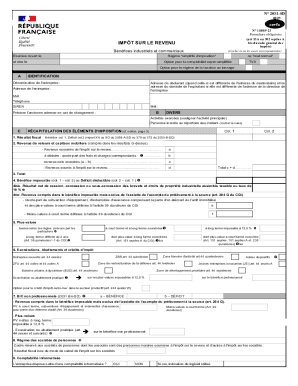

Filling out the Formulaire 2031-SD is a crucial step for individuals and businesses subject to income tax on industrial and commercial profits. This guide provides clear, step-by-step instructions to help users complete the form accurately and efficiently in an online environment.

Follow the steps to complete the Formulaire 2031-SD online.

- Click ‘Get Form’ button to obtain the document and open it in your preferred format.

- Begin with the identification section, where you need to provide your business name, address details, email, and phone number. Ensure all information is correct as it will be used for official correspondence.

- Explore the activities section to specify the main activity of your business. Underline the primary activity and indicate if you are registered in the business directory.

- Proceed to the tax summary section. Enter your fiscal result into the correct columns, providing the profit or deficit amounts derived from previous reports.

- Fill in the taxable profits or deductible deficits and include any capital gains and losses. This section typically involves calculations that may require additional documents for accuracy.

- Review any exemptions or tax credits applicable to your situation, especially if you qualify for any stipulations mentioned in the notice related to newly created businesses or specific tax zones.

- Ensure all required fields are filled, including the software used if any computerized accounting system is in place. Double-check your entries for completeness.

- Finally, save your changes, and you will have the option to download, print, or share the completed form as needed.

Complete your Formulaire 2031-SD online for a hassle-free filing experience.

Comment faut-il déclarer les BIC ? Quel que soit son régime fiscal, l'entrepreneur, doit déclarer chaque année ses revenus dans la déclaration complémentaire des professions non salariées des revenus n°2042 C pro jointe à la déclaration spécifique de son régime d'imposition.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.