Loading

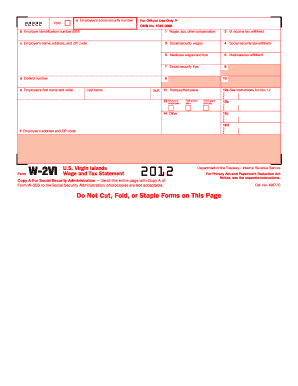

Get W2 Form 2012

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the W2 Form 2012 online

This guide aims to provide clear, step-by-step instructions on how to fill out the W2 Form 2012 online. By following these detailed instructions, users will be equipped to accurately complete their tax documents for filing.

Follow the steps to accurately fill out the W2 Form 2012 online.

- Press the ‘Get Form’ button to access the W2 Form 2012 and open it in your preferred editor.

- In section 'a', enter the employee’s social security number.

- In section 'b', provide the employer identification number (EIN).

- Next, fill in section 'c' with the employer’s name, address, and ZIP code.

- In box 1, you need to report total wages, tips, and other compensation received by the employee.

- In box 2, input the amount of VI income tax withheld from the employee's earnings.

- For boxes 3 through 7, enter the corresponding amounts for social security wages, social security tax withheld, Medicare wages and tips, and Medicare tax withheld.

- In boxes 8 and 11, if applicable, report any tips received by the employee and nonqualified plans distributions.

- For box 12, make sure to include any necessary codes as indicated in the instructions.

- Complete section 'e' by entering the employee’s first name, middle initial, and last name, followed by any suffix.

- Fill in section 'f' with the employee's address and ZIP code.

- Review all sections for accuracy before finalizing.

- Once completed, users can save the document, download a copy, print it, or share it as needed.

Start completing your W2 Form 2012 online today!

You may be eligible for more credits this year Set. ... If you claimed the earned income credit in 2019 but had lower income in 2020, you can use your 2019 income again to claim the credit. There are other credits that families may be eligible for or can use their 2019 income to claim in 2020, such as the child tax credit.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.