Loading

Get Promissory Note Michigan

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Promissory Note Michigan online

Filling out the Promissory Note Michigan online is a straightforward process that can help facilitate the sale of a vehicle between a buyer and a seller. This guide provides clear, step-by-step instructions to ensure you complete the document accurately and effectively.

Follow the steps to fill out your Promissory Note Michigan online

- Press the ‘Get Form’ button to access the Promissory Note Michigan. This will allow you to open and review the document in your preferred editor.

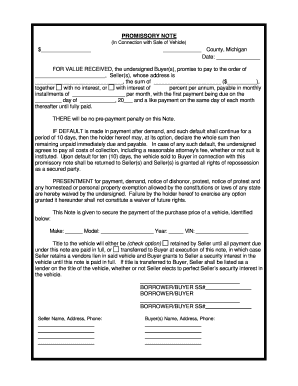

- In the first blank, enter the purchase amount for the vehicle in dollars. This is the total amount that the buyer agrees to pay the seller.

- Identify and fill in the county in Michigan where the agreement is being made. Next, write the date on which you are completing the document.

- In the section labeled 'FOR VALUE RECEIVED', enter the name of the buyer(s) who will be making the payments and the name of the seller(s) who is receiving the payment.

- Complete the seller's address, ensuring that it is accurate to maintain proper communication.

- Enter the sum being paid, formatted as a specific dollar amount, next to the written dollar amount. This will help clarify the financial agreement.

- Decide whether the loan will have interest and indicate the applicable percentage if interest is to be charged along with the monthly installment amount.

- Specify the due date for the first payment and continue detailing the payment schedule, ensuring that monthly payment amounts are clearly stated.

- Read the conditions regarding default and the rights of the seller in case of non-payment. Make sure you understand the implications of these terms.

- Fill in the vehicle details including make, model, year, and VIN to identify the vehicle that is being sold under this agreement.

- Indicate whether the seller retains the title of the vehicle until full payment is made or if the title is transferred to the buyer upon signing the note.

- Lastly, have both the buyer(s) and seller(s) sign the document as well as include their social security numbers, contact information, and any other personal data required.

- Once all fields are complete, you can save the changes, download, print, or share the document as needed.

Complete your documents online today for a seamless transaction!

You can use a template or create a promissory note online. But before you begin, you'll need to gather some information and make decisions about the way the loan will be structured. First, you'll need the names and addresses of both the lender (or "payee") and the borrower.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.