Loading

Get Non Borrower Credit Authorization Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Non Borrower Credit Authorization Form online

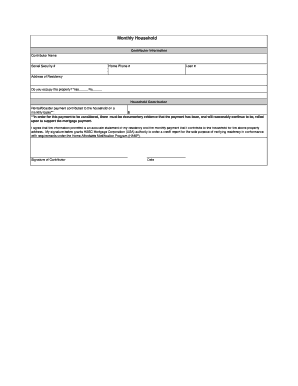

Filling out the Non Borrower Credit Authorization Form online is a straightforward process that allows you to provide necessary information for credit verification. This guide will walk you through each section of the form to ensure a smooth completion.

Follow the steps to complete the form accurately.

- Click 'Get Form' button to obtain the form and open it in the editor.

- Enter your contributor name in the designated field. This should be your full legal name as it appears on official documents.

- Input your Social Security number in the corresponding field. This information is required for identity verification and should be entered accurately.

- Provide your home phone number. Ensure that the number is current and can be used for contact purposes.

- Enter your loan number in the appropriate section. This number is typically found in your loan documents and is essential for identification.

- Fill in your current address of residency. This should reflect your primary living address.

- Indicate whether you occupy the property by selecting 'Yes' or 'No'. This information is vital for verifying your residency.

- State the monthly rental or boarder payment you contribute to the household in the specified field. Make sure this amount has supporting documentation.

- Review the agreement stating the accuracy of the residency information and your contribution. Ensure you understand the implications of the statement.

- Sign the form in the designated signature field. Your signature authorizes HSBC Mortgage Corporation (USA) to order a credit report for verification.

- Date the form by entering the current date in the provided field.

- Once all sections are filled out, you can save changes, download, print, or share the form as necessary.

Complete your documents online today to ensure timely processing.

Related links form

A person who is an owner but does not have an obligation to repay the loan is sometimes referred to as a non-obligor or non-borrower. One easy solution would be to have the additional name(s) added to the deed after closing. ... In conclusion, you can be a title holder and not be obligated to the loan.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.