Loading

Get Form M1ma

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form M1ma online

Filling out the Form M1ma online can streamline the process of applying for the marriage credit. This guide will provide clear, step-by-step instructions to help you navigate each section of the form effectively.

Follow the steps to complete the Form M1ma online.

- Click the 'Get Form' button to access the Form M1ma. The form will open in the appropriate editor for you to fill out.

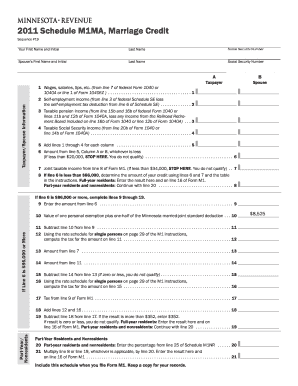

- Begin by entering your first name and initial, and then your last name in the designated fields. Be sure to include your Social Security number as well as your spouse’s first name, initial, last name, and Social Security number.

- Proceed to section A, where you will complete lines 1 through 5. This requires you to report the earned income for both you and your spouse, including wages, self-employment income, taxable pension income, and taxable Social Security income.

- On line 6, input the smaller amount from line 5, column A or B. If this amount is less than $20,000, you will not qualify for the credit and can stop here.

- For line 8, if your amount on line 6 is at least $20,000 but less than $86,000, use the provided table in the instructions to find your credit amount and enter it here. Full-year residents should continue with line 9 if line 6 is $86,000 or more.

- If line 6 is $86,000 or more, you will fill out lines 9 through 19. Start by entering the amount from line 6 on line 9. Then, follow the instructions for calculating derived values through the subsequent lines, including exemptions and tax computations.

- Complete the calculations required in lines 12 to 16 using the appropriate rate schedule. Make sure to carry forward the correct amounts from previous lines to ensure accuracy.

- If applicable, section for part-year residents should be filled out starting at line 20. Enter the percentage from the specified line of Schedule M1NR to determine your applicable credit.

- Finally, review all entries for accuracy before saving. You can now save your changes, download, print, or share the completed form as necessary.

Get started on filling out your Form M1ma online today to ensure you maximize your marriage credit.

If you are a full-year Minnesota resident, you must file a Minnesota income tax return if your income meets the state's minimum filing requirement. (See the table below.) If you are a part-year resident or nonresident, you must file if your Minnesota gross income meets the state's minimum filing requirement.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.