Loading

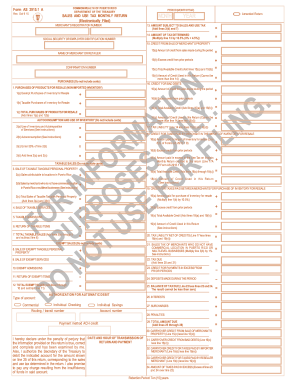

Get Form As 2915.1 A Sales And Use Tax Monthly Return... - Hacienda Pr

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form AS 2915.1 A Sales and Use Tax Monthly Return online

Completing the Form AS 2915.1 A Sales and Use Tax Monthly Return is a crucial responsibility for merchants operating in Puerto Rico. This guide provides clear, step-by-step instructions to help users fill out the form accurately and efficiently, ensuring compliance with tax obligations.

Follow the steps to complete your form successfully.

- Press the ‘Get Form’ button to access the form and open it in the editor.

- Enter your Merchant’s Registration Number, ensuring it corresponds to the seven digits assigned by the system.

- Provide your Social Security or Employer Identification Number, depending on your business structure.

- Specify the Name of Merchant or Retailer. Use the trade name for the establishment or your full name if a sole proprietor.

- Indicate the Period (Month/Year) to reflect the correct timeframe for which you are filing.

- If applicable, select the 'Amended Return' option to correct any previous omissions or mistakes.

- Fill in sections regarding Purchases of Products for Resale, detailing Exempt and Taxable Purchases.

- Complete the Autoconsumption and Use of Inventory section, providing necessary details on any personal use of inventory.

- Document Sales of Taxable Tangible Personal Property and Taxable Services, ensuring all relevant amounts are included.

- Calculate your Tax Liability by summing the relevant entries and applying the appropriate tax rates, ensuring to check for available credits.

- Review the entire form for accuracy and completeness.

- Once satisfied, save your changes, download, print, or share the completed form as necessary.

Complete your documents online with confidence and ensure timely submission for compliance.

Puerto Rico has a statewide sales tax rate of 10.5%, which has been in place since 2006. Municipal governments in Puerto Rico are also allowed to collect a local-option sales tax that ranges from 1% to 1% across the state, with an average local tax of 1% (for a total of 11.5% when combined with the state sales tax).

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.