Loading

Get Demand For Delay Of Sale Iowa Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Demand For Delay Of Sale Iowa Form online

Filling out the Demand For Delay Of Sale Iowa Form online can be a straightforward process if you follow the right steps. This guide aims to provide clear and user-friendly instructions to help you efficiently complete the form.

Follow the steps to fill out the Demand For Delay Of Sale Iowa Form online.

- Click the ‘Get Form’ button to access the form and open it in your preferred online editor.

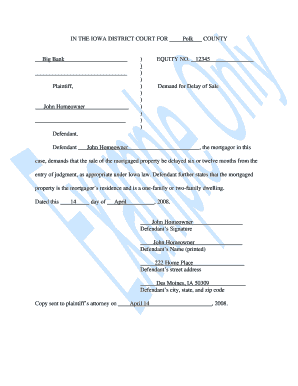

- In the first section, provide your name as the defendant (for example, John Homeowner) and ensure it accurately reflects the legal documents.

- Fill in the equity number, which is crucial for the identification of your case. If you don't have it, check your court documents for reference.

- Next, include the name of the plaintiff (for instance, Big Bank) as it appears in court records.

- Indicate the county where the case is filed, in this instance, Polk County.

- State the demand for a delay of sale and specify whether you are requesting a delay of six or twelve months from the date of judgment.

- Confirm that the mortgaged property is your primary residence and specify if it is a one-family or two-family dwelling.

- Date the form appropriately, indicating the current date when filling out the form.

- Sign the form by entering your signature and printing your name underneath. Provide your street address, city, state, and ZIP code.

- Finally, ensure a copy is sent to the plaintiff's attorney, noting the date you will send it.

- Once you have filled out all sections, you can save your changes and choose to download, print, or share your completed form.

Complete your Demand For Delay Of Sale Iowa Form online today to ensure timely processing.

At least 30 days before filing suit, the lender must mail the homeowner a notice of default and the right to cure the mortgage. The homeowner is not in foreclosure at this point, but if notices from the lender continue unheaded for 120 days, then the lender can legally move forward with the foreclosure.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.