Loading

Get Dp-10-es

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the DP-10-ES online

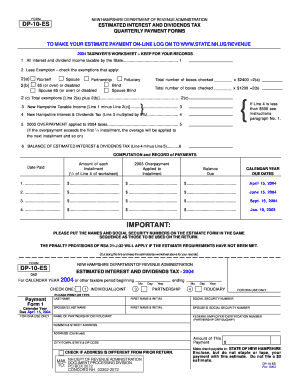

The DP-10-ES form is used to report estimated interest and dividends tax for individuals, partnerships, or fiduciaries in New Hampshire. This guide provides step-by-step instructions to help users accurately complete the form online, ensuring compliance with state regulations.

Follow the steps to effectively complete the DP-10-ES online.

- Press the ‘Get Form’ button to obtain the DP-10-ES form and open it in the online editor.

- Begin by entering the calendar year for which you are filing the estimated taxes at the top of the form.

- Select the type of taxpayer by checking the appropriate box for ‘Individual/Joint’, ‘Partnership’, or ‘Fiduciary’.

- Fill out your last name, first name, and initial in the designated fields, as well as your social security number and those of your spouse, if applicable.

- Provide the name of the partnership or fiduciary, along with the federal employer identification number if relevant.

- Input your complete address, including number, street, city, state, and ZIP code.

- Calculate the total estimated interest and dividends taxable by the state, as instructed in Line 1 of the taxpayer’s worksheet.

- Indicate applicable exemptions by checking the respective boxes in the exemption section (Lines 2(a) and 2(b)). Calculate the total exemptions and input the sum in Line 2(c).

- Subtract the total exemptions from the taxable income to determine the New Hampshire taxable income, and input this value in Line 3.

- Calculate the New Hampshire interest and dividends tax by multiplying the taxable income by the rate specified (5%) and input this result in Line 4.

- If there was an overpayment from the previous year, indicate the amount on Line 5, and deduct it from Line 4 to get the balance of estimated tax due on Line 6.

- Detailed records of each installment payment due must be completed, specifying the amount and date for each quarter.

Complete your DP-10-ES form online to ensure timely and accurate submission of your estimated interest and dividends tax.

Related links form

INDIVIDUALS: Individuals who are residents or inhabitants of New Hampshire for any part of the tax year must file if they received more than $2,400 of gross interest and/or dividend income for a single individual or $4,800 of such income for a married couple filing a joint New Hampshire return.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.