Loading

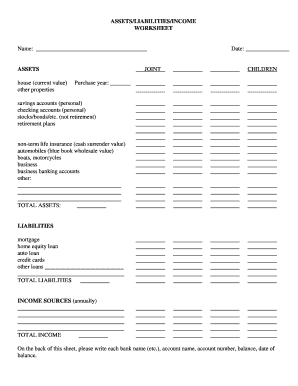

Get Assets/liabilities/income Worksheet Name: Assets House (current Value) Other Properties Joint Date

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the ASSETS/LIABILITIES/INCOME WORKSHEET Name: ASSETS House (current Value) Other Properties JOINT Date online

Filling out the ASSETS/LIABILITIES/INCOME WORKSHEET is an essential step in assessing your financial situation. This guide provides clear, step-by-step instructions to help you accurately complete each section of the form online.

Follow the steps to accurately complete your worksheet.

- To start, please click the ‘Get Form’ button to access the worksheet. This will allow you to open the document in your online editor.

- In the first section of the worksheet, fill in your name at the top where indicated. This identifies the person completing the form.

- Next, focus on the 'ASSETS' section. Record the current value of your house and any other properties you jointly own. Be sure to include as much detail as possible including purchase years and values.

- List your savings accounts, checking accounts, and any stocks or bonds you hold outside of retirement plans. Include the total value of these assets.

- Continue with non-term life insurance, automobiles including their blue book value, and any business assets you may have. Remember to add any other relevant assets in the 'other' category.

- Calculate the total assets and write this figure in the designated space. It’s important to ensure that your calculations are accurate.

- Move on to the 'LIABILITIES' section. Enter all loans including mortgages, home equity loans, auto loans, and any credit card debts you currently owe.

- For each liability, provide the total amount owed and ensure it is clearly listed next to the respective category.

- Sum up your total liabilities and document this in the respective area of the form.

- In the 'INCOME SOURCES (annually)' section, estimate and list all sources of your annual income. This includes salaries, investments, and any other income streams.

- On the back of the worksheet, document your bank details. Fill in the bank name, account number, balance, and date of that balance for checking, savings, and money market accounts.

- Repeat the same for credit cards by entering account numbers, balances, and dates for each credit card you own.

- For investment and retirement accounts, list details including the type of account, account number, value, and date. Make sure each entry is thorough and precise.

- Lastly, review your completed worksheet for any errors or missing information. After ensuring accuracy, you can save your changes, download, print, or share the filled-out form as needed.

Complete your ASSETS/LIABILITIES/INCOME WORKSHEET online today and take control of your financial future.

Related links form

Examples of Assets Cash and cash equivalents. Accounts receivable (AR) Marketable securities. Trademarks. Patents. Product designs. Distribution rights. Buildings.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.