Loading

Get Deferred Annuity Claim Form - Genworth Financial

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Deferred Annuity Claim Form - Genworth Financial online

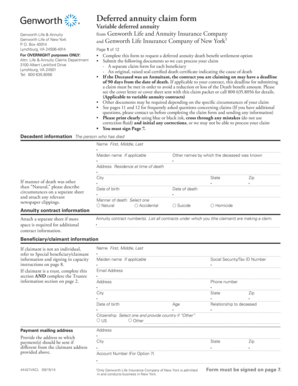

Filing a deferred annuity claim can seem daunting, but with the right guidance, it can be a smooth process. This guide will walk you through the Deferred Annuity Claim Form provided by Genworth Financial, ensuring you understand each section and field as you complete it online.

Follow the steps to successfully complete your deferred annuity claim form.

- Click the ‘Get Form’ button to obtain the form and open it in your preferred editor.

- Begin by filling in the decedent information. Provide the full name, maiden name, and any other names the deceased may have been known by. Ensure the address is the residency at the time of death.

- Enter the date of birth and date of death, and select the manner of death from the given options: Natural, Accidental, Suicide, or Homicide.

- List all annuity contract numbers associated with the claim. If you need more space, attach a separate sheet with additional contract information.

- Proceed to the beneficiary and claimant information section. Include the name, mailing address, and relationship to the deceased. Ensure to provide accurate contact details and Social Security or Tax ID number.

- If the claimant is a trust, complete the trustee information section. Provide the trust's name, Tax Identification Number, and the date of the trust agreement.

- Choose a settlement option that suits your needs. Carefully read through options such as lump sum distribution, purchasing a new annuity, continuing the annuity, or electing for delayed distribution.

- Complete the beneficiary designation section, ensuring that the percentages total 100% and adding separate signed sheets for additional beneficiaries if necessary.

- Fill out the tax withholding information accurately. Specify if you want federal or state taxes withheld from your payment.

- Sign the declaration section on page 7, ensuring that all information is correct and complete. This section confirms your authority to claim the proceeds and the accuracy of your submitted information.

- Finally, save any changes made to the form. You can download, print, or share the completed form as necessary.

Complete your deferred annuity claim form online today, ensuring all required information is submitted correctly for a smooth processing experience.

Related links form

With a few exceptions, you can cash out payments from your structured settlement or annuity at any time. However, making early withdrawals before reaching age 59 ½ may result in tax penalties and a 10 percent early withdrawal fee.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.