Loading

Get How To Complete Form Nol 85a

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the How To Complete Form Nol 85a online

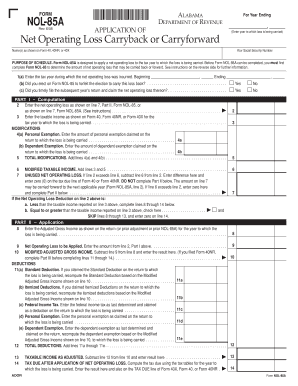

Filling out Form Nol 85a online can seem challenging, but with the right guidance, it becomes a straightforward process. This guide will walk you through each section of the form to ensure you complete it accurately and efficiently.

Follow the steps to effectively complete Form Nol 85a online.

- Press the ‘Get Form’ button to access the form and open it in the online editor.

- Enter the year for which the net operating loss is being applied in the designated field.

- Fill in your name as it appears on Form 40, 40NR, or 40X in the appropriate section of the form.

- Input your Social Security number directly into the field labeled for it.

- Review the instructions on the form about whether you elected to forfeit the carryback election.

- Complete Part I by entering the net operating loss amount derived from Form NOL-85.

- Continue by entering the taxable income for the year to which the loss is being carried.

- In the modifications section, enter the amounts for personal and dependent exemptions as they apply.

- Add the relevant modifications to calculate the total; enter this figure in the designated field.

- Calculate and enter the modified taxable income by adding your taxable income and modifications.

- If your net operating loss exceeds the modified taxable income, record this in the unused net operating loss section.

- Proceed to complete Part II and follow the instructions for entering adjusted gross income and deductions.

- Finally, review all sections for accuracy before saving, downloading, or printing the completed form.

Complete your forms online today to streamline the process and ensure accuracy!

If the taxpayer decides instead to carry forward the 2018 or 2019 NOLs, it is imperative that the election to waive the carryback period is properly and timely made for each year in which the NOL is generated.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.