Loading

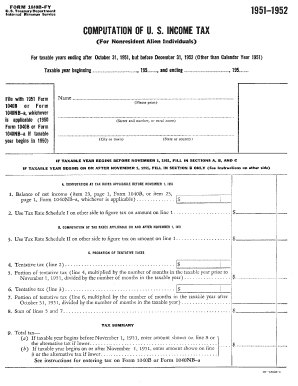

Get 1040b

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 1040b online

Navigating tax forms can be a daunting task, but with the right guidance, filling out the 1040b online can be a straightforward process. This guide will provide you with step-by-step instructions to ensure you accurately complete the form and meet your filing requirements.

Follow the steps to effectively complete the 1040b online.

- Click the ‘Get Form’ button to access the 1040b form in an online format. This will allow you to view the form in an editable format.

- Review the introductory information on the form to understand its purpose and the specific requirements. Ensure that you have all necessary documents and information handy before proceeding.

- Begin entering your personal information in the designated sections. This typically includes your name, address, and Social Security number. Double-check for accuracy as this information is critical.

- Proceed to the income section of the form. Input your total income and any other relevant financial information as prompted. Ensure that you report all applicable income sources.

- Complete the deductions section. Here, you can list any deductions that you are eligible for, such as student loan interest or mortgage interest. Review eligibility criteria to maximize your deductions.

- Review the tax and credits section. Calculate your taxes owed or any refundable credits you may qualify for, based on the information provided earlier in the form.

- Before finalizing, review the entire form for any errors or omissions. This last check is vital to ensure your submission is accurate and complete.

- Once you have completed the form, you can save your changes, download a copy for your records, print a hard copy to submit, or share the form as needed.

Start completing your 1040b online today to ensure timely and accurate filing.

The standard deduction for 2020 is $12,400 for singles and $24,800 for married joint filers. ... Single filers who are blind or over 65 are eligible for a $1,650 additional standard deduction. This is up $50 from 2019.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.