Loading

Get Rsa Alabama Retirement Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the RSA Alabama Retirement Form online

Completing the RSA Alabama Retirement Form online can seem challenging, but this guide will provide clear, step-by-step instructions to help you navigate the process. By following these detailed steps, users can ensure accurate submission of their retirement distribution and rollover options.

Follow the steps to successfully fill out the form online.

- Click ‘Get Form’ button to obtain the form and access it in your preferred editing tool.

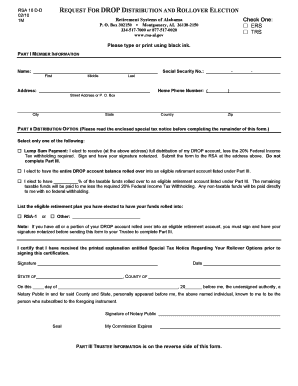

- In Part I, enter your personal information. Provide your full name, home address, and contact number. Ensure all details are accurate to avoid processing delays.

- In Part II, select your distribution option by checking the appropriate box. Be sure to read the special tax notice before making your choice. Decide whether to receive a lump sum payment or roll over your account balance.

- If electing to roll over some or all of your account, specify the percentage you wish to roll over and provide the name of the eligible retirement plan. Be attentive to the tax implications of your choice.

- Sign and date the form in the designated section. Your signature must be notarized before submission if you chose the rollover option. Ensure the notary public is present to witness your signing.

- Complete Part III by providing the trustee information relevant to the rollover, including the name, social security number, and account details. The trustee may further aid in completing this section.

- Review all fields for accuracy and completeness. Once everything is correct, save your changes to the document.

Start completing your forms online today for a smooth retirement process.

Alabama has a 10 year vesting period. While educators qualify for a pension after 10 years of service, however, the pension may still not be worth all that much. Moreover, educators can't begin to collect it until they hit the state's retirement age.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.