Loading

Get 1040 Schedule 1

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 1040 Schedule 1 online

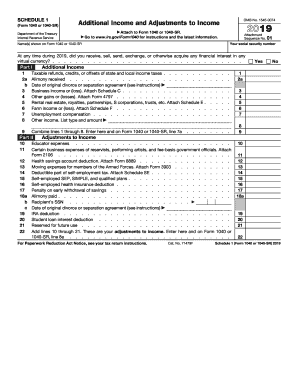

Filling out the 1040 Schedule 1 is an important step in the tax preparation process, allowing users to report additional income and adjustments to income. This guide provides a clear and straightforward approach to completing the form online.

Follow the steps to successfully fill out the form

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering your social security number and the name(s) shown on Form 1040 or 1040-SR at the top of the Schedule 1.

- In Part I, you will report additional income. For line 1, indicate any taxable refunds, credits, or offsets of state and local income taxes. If applicable, enter the amount.

- Continue to line 2a to report any alimony received. If you are required to indicate the date of the original divorce or separation agreement, fill in line 2b.

- For business income or loss, proceed to line 3. You must attach Schedule C if you have business income.

- If you have other gains or losses, reference line 4 and attach Form 4797 to report these figures.

- Line 5 is for reporting income from rental real estate, royalties, partnerships, S corporations, trusts, etc. Attach Schedule E as needed.

- For any farm income or loss, report the amount on line 6 and remember to attach Schedule F.

- Indicate your unemployment compensation on line 7, if applicable.

- Finally, on line 8, you will report other income. List the type and amount as requested.

- After completing lines 1 through 8, total the amount and enter it on line 9. This total will also go on Form 1040 or 1040-SR, line 7a.

- In Part II, report any adjustments to income starting with line 10 for educator expenses.

- Continue filling out lines 11 through 22 based on your eligibility for deductions such as health savings account deductions, moving expenses, and other relevant adjustments.

- Once all relevant lines are filled, total your adjustments on line 22 and transfer this amount to Form 1040 or 1040-SR, line 8a.

- After reviewing for accuracy, save your changes, and you can then download, print, or share the completed form as needed.

Complete your documents online with confidence and ensure your tax return is accurate.

Include this amount on line 25 of your Form 1040 or 1040-SR and attach a copy of Schedule K-1 (Form 1041) to your return.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.