Loading

Get Excelpay Employee Profile Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the ExcelPay Employee Profile Form online

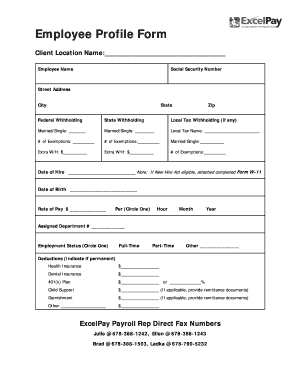

Filling out the ExcelPay Employee Profile Form online is a crucial step in ensuring accurate employee documentation. This guide provides you with clear and supportive instructions on how to complete each section of the form efficiently.

Follow the steps to accurately complete the form.

- Click 'Get Form' button to obtain the form and open it in the editor.

- Begin by entering the client location name in the designated space at the top of the form. This helps identify the specific employment location.

- Fill in your full employee name in the designated field. Ensure that it matches your legal documents for consistency.

- Provide your Social Security number. This information is sensitive, so ensure it is entered accurately to avoid any discrepancies.

- Complete your street address, city, state, and zip code. Ensure each field is filled out correctly to facilitate proper documentation and correspondence.

- Proceed to the federal withholding section to specify the amount you want withheld from your paycheck for federal taxes.

- In the state withholding section, indicate the amount for state tax withholding, if applicable.

- If applicable, fill in the local tax withholding section and specify the name of the local tax.

- Indicate your marital status by selecting either married or single. Repeat this process as required for additional withholding options.

- Detail the number of exemptions you are claiming and provide any extra withholding amounts as needed.

- Enter your hire date in the provided space. If you are a new hire eligible for the New Hire Act, remember to attach the completed Form W-11.

- Fill in your date of birth accurately, as this will be used for identification purposes.

- Specify your rate of pay in dollars, and choose whether this is on an hourly, monthly, or yearly basis by circling the appropriate option.

- Indicate your assigned department number and select your employment status from full-time, part-time, or other options.

- Complete the deductions section by clearly indicating the amounts for health insurance, dental insurance, 401(k) plans, child support, and any garnishments if applicable.

- Review all the information entered to ensure it is accurate and complete. Once verified, you can save changes, download, print, or share the form as necessary.

Complete your documents online today for efficient management.

To create an employee task list in Excel, list tasks in one column and assign employees in another. Include due dates and status updates to keep track of progress. The ExcelPay Employee Profile Form can help you structure this list, ensuring clarity and accountability within your team.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.