Loading

Get Is There A Fillable Sc1065 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the Is There A Fillable SC1065 Form online

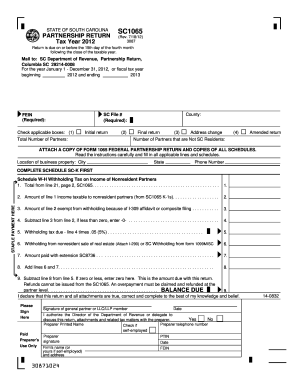

The SC1065 form is essential for partnerships operating in South Carolina to report income, deductions, and credits. This guide offers a comprehensive, step-by-step explanation of how to fill out the SC1065 form online effectively, ensuring that all necessary information is accurately recorded.

Follow the steps to complete the SC1065 form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin with filling in the legal name and address of the partnership in the designated fields. Ensure that both the FEIN and SC File numbers are provided, as they are mandatory.

- Indicate the county where your partnership is located by selecting the appropriate option from the dropdown menu. Check all applicable boxes related to your submission, such as 'Initial Return,' 'Final Return,' 'Address Change,' or 'Amended Return'.

- Complete Schedule SC-K by entering amounts from the federal Schedule K into the respective columns. This involves allocating incomes, losses, deductions, and credits appropriately.

- Move to lines 18-20 to complete the apportionment section. Enter total sales or gross receipts and compute the apportionment factor to determine the net business income taxable to South Carolina.

- Prepare SC1065 K-1 forms for each partner, ensuring that the amounts taxable to nonresident partners are accurately listed. Attach these to your SC1065 submission.

- Complete Schedule W-H for Withholding Tax on Income of Nonresident Partners by calculating the withholding tax due, entering necessary figures, and ensuring all data aligns with prior sections.

- Once all sections are filled out, review your entries for accuracy. Save your changes, then download, print, or share the completed form as necessary.

Start filling out your SC1065 form online today to ensure timely and accurate submission.

Your AGI is between $16,000 and $72,000 regardless of age. You are Active Duty Military and your AGI is $72,000 or less.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.