Loading

Get Initial Maximum Rate Filing Schedule - Consumer Sc

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the INITIAL MAXIMUM RATE FILING SCHEDULE - Consumer Sc online

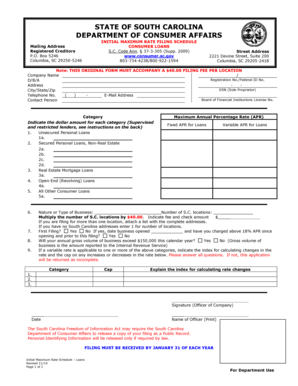

This guide provides clear and comprehensive instructions for completing the Initial Maximum Rate Filing Schedule for consumer loans in South Carolina. By following these steps, users can successfully file the necessary documentation online and ensure compliance with state regulations.

Follow the steps to effectively complete your filing schedule online.

- Press the ‘Get Form’ button to access the Initial Maximum Rate Filing Schedule and open it in your preferred online editor.

- Begin by entering your company name along with your registration number or Federal ID Number in the designated fields.

- Complete the Doing Business As (D/B/A) section, and fill in your company address, including the city, state, and zip code.

- If applicable, enter the Social Security Number for sole proprietors, along with a valid telephone number and email address.

- Indicate your Board of Financial Institutions License Number and the contact person's name for your business.

- For each category of loans you offer, enter the dollar amount in the respective fields. Categories include Unsecured Personal Loans, Secured Personal Loans (Non-Real Estate), Real Estate Mortgage Loans, Open-End (Revolving) Loans, and All Other Consumer Loans.

- Next, specify the maximum annual percentage rates (APR) for fixed and variable loans where applicable.

- Indicate the nature or type of your business and the number of South Carolina locations your business operates.

- Calculate the total filing fee by multiplying the number of locations by $40. Indicate the fee amount and attach a check made payable to the S.C. Department of Consumer Affairs.

- Answer the questions regarding your filing status, indicating if this is your first filing and if your business will exceed $150,000 in gross volume this year.

- If a variable rate applies, elaborate on the index for calculating changes in the rate and specify any caps on increases or decreases.

- Ensure all fields are filled out completely, sign the document, and date it.

- Review your completed form for accuracy, save your changes, and prepare to download, print, or share the form as needed.

Take action now and complete your Initial Maximum Rate Filing Schedule online for prompt processing.

The general usury limit is 12%, or four points above the average T-Bill rate for the past 26 weeks, whichever is greater.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.