Loading

Get Tsp Tsp-77 2018-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the TSP TSP-77 online

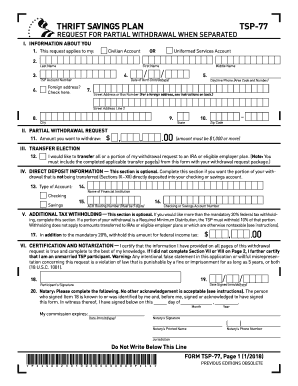

The TSP TSP-77 form is essential for requesting a partial withdrawal from your Thrift Savings Plan account when separated from service. This guide will provide you with clear, step-by-step instructions to complete this form online, ensuring a smooth experience in managing your retirement funds.

Follow the steps to successfully complete the TSP TSP-77 form online.

- Click ‘Get Form’ button to obtain the TSP TSP-77 and open it in your online editor.

- In Section I, provide personal information including your last name, first name, middle name, birth date, and TSP account number. Specify whether you are filing for a civilian or uniformed services account.

- If applicable, indicate if you have a foreign address by checking the box provided, and fill out your daytime phone number and address details.

- In Section II, specify the amount you wish to withdraw, ensuring that it meets the minimum withdrawal requirement of $1,000.

- In Section III, you can indicate if you would like to transfer all or a portion of your withdrawal to an IRA or an eligible employer plan. Remember to include any additional transfer pages required.

- In Section IV, if you prefer, complete your direct deposit information by indicating the type of account (checking or savings), the financial institution's name, routing number, and account number.

- Section V provides an option for additional tax withholding. If you wish to withhold more than the mandatory 20% federal tax, specify the additional amount.

- In Section VI, certify the information provided is correct by signing and dating the form. You may also need a notary acknowledgment as required.

- If you are married, Sections VII and VIII detail the requirements for spousal consent, including necessary signatures and notary information.

- Complete Sections IX and X if you are transferring the traditional balance, specifying the transfer amounts and the information required for the IRA trustee or plan administrator.

- Complete Sections XI and XII similarly for transferring the Roth balance, ensuring to provide the required information to facilitate the transfer.

- Once all sections are completed, save your changes, and you may download, print, or share the form as needed.

Start filling out the TSP TSP-77 online today to manage your retirement plans effectively.

Related links form

To obtain your TSP 1099-R form, log into your TSP account and navigate to the tax documents section. The 1099-R form is typically available electronically for the tax year in which you received your distribution. Understanding this document is crucial for accurately reporting your taxes.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.