Loading

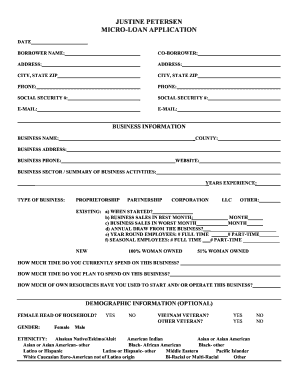

Get Justine Petersen Micro-loan Application

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Justine Petersen Micro-Loan Application online

Completing the Justine Petersen Micro-Loan Application online is a straightforward process that can be managed with a few simple steps. This guide will walk you through each section of the application to ensure that you provide all necessary information accurately and completely.

Follow the steps to successfully complete your application.

- Click the ‘Get Form’ button to access the application form and open it in your preferred online editing tool.

- Begin by entering the date and your name in the designated borrower sections. If applicable, include your co-borrower’s information as well.

- Provide your current address, including city, state, and ZIP code. Repeating this for the co-borrower if necessary.

- Fill in your and your co-borrower's contact information, including phone number, social security number, and email address.

- In the business information section, input the business name, county, business address, and phone number. If you have a business website, include that as well.

- Indicate the business sector and summarize the business activities. Provide details on years of experience and select the type of business from the options provided.

- If applicable, provide details on existing business operations, including when the business started, sales figures for both best and worst months, annual draw, and employee numbers.

- For new businesses, specify your time commitment and financial resources spent to start or operate your business.

- Fill out optional demographic information, specifying gender, veteran status, and ethnicity as relevant.

- Provide employment information for both you and your co-borrower, including employer details, job title, salary, and dates of employment.

- Summarize annual household income, including income sources, household size, and whether you receive public assistance.

- List your landlord's name and contact information, as well as your duration of residence.

- Add personal references, including names, addresses, and contact information.

- In the financial information section, provide both personal and business income details along with expenses.

- Detail the specific loan requirements, including the amount desired and planned use for the funds.

- Review your collateral details, specifying what you plan to use and providing property or vehicle information.

- Answer credit-related questions honestly and provide any necessary documents as attachments.

- Finalize the application by signing the form, ensuring both borrower and co-borrower sign where applicable.

- Attach all required documents, including the application fee, business plan, identification, paystubs, bank statements, tax returns, and rental agreement.

- Save your changes, download a copy for your records, and share or print the completed application for submission.

Begin your application process online today to take the first step toward securing funding for your business.

It can be difficult to get a small-business loan if you don't have good credit and strong finances. It may also be difficult to get a loan if you are a new business. Although there are funding options available for startups and businesses with bad credit, these products typically have higher interest rates.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.