Get Spendthrift Trust Forms

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Spendthrift Trust Forms online

Filling out the Spendthrift Trust forms online is a crucial step in establishing a trust designed to protect beneficiaries' assets while providing for their financial needs. This guide will walk you through each section of the forms in a clear and user-friendly manner, ensuring that even those with minimal legal experience can succeed.

Follow the steps to fill out the Spendthrift Trust Forms online:

- Press the ‘Get Form’ button to obtain the Spendthrift Trust forms and open them for editing. This action allows you to easily access all required sections of the forms for completion.

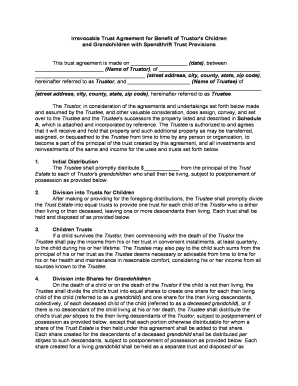

- Begin filling out the document by entering the date of the agreement. Ensure this is accurate, as it marks when the trust becomes effective.

- Input the full name and address of the Trustor. This information is essential, as it identifies the individual creating the trust.

- Next, incorporate the name and address of the Trustee. This person or entity will manage the trust according to its terms.

- Review and complete Schedule A by listing the property being transferred into the trust. Accurate details are critical for administering the trust assets.

- Proceed to the Initial Distribution section, where you will specify the amount to be distributed to each grandchild.

- Continue by dividing the Trust Estate into separate trusts for each child. Document whether the children are living or deceased and mention their descendants.

- Fill out the Children Trusts section, defining how income will be distributed to children during their lifetimes.

- In the Division into Shares for Grandchildren section, clarify how to handle distributions after the death of a child.

- Complete the Grandchildren’s Trusts section, detailing the income distribution plans for grandchildren.

- Address the Right of Withdrawal, specifying the age at which grandchildren can withdraw their share.

- Detail the Power of Appointment to clarify how distributions are handled if a grandchild passes away.

- Continue with the Distribution to Descendants section to outline the protocol for unallocated shares upon a grandchild's death.

- Complete the Distribution to Minors section, ensuring to note any custodianship arrangements required.

- Fill in the Payments to Minors or Incompetents section to define how funds should be managed for those unable to control their affairs.

- Fill in the Spendthrift Provisions, ensuring that this section is clear to protect beneficiary interests.

- Complete the Accrued and Undistributed Income section for clarity on future income arrangements.

- Define any Common Fund arrangements that might simplify the administration of the trust.

- Outline the Powers of the Trustee, including any special powers that create flexibility in managing trust assets.

- Complete the Annual Account; Compensation section to define how the Trustee will report on trust activities.

- In the Discretionary Termination section, state the thresholds for trust termination, if applicable.

- Ensure to indicate the governing law at the end of the document to comply with state regulations.

- Conclude by providing adequate spaces for the signatures of the Trustor and Trustee, ensuring all parties authorize the trust.

- Once all sections are complete, save your changes, and download or print the completed form for your records or for future sharing.

Start filling out the Spendthrift Trust Forms online today to secure your beneficiaries' financial future.

A spendthrift trust puts restrictions on the beneficiary's access to trust principal. Essentially, the beneficiary cannot access the trust principal, or promise it to anyone else. ... Instead of having direct access to trust property, the beneficiary receives benefit from the trust through the trustee named in the trust.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.