Loading

Get Form St 133gt

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form St 133gt online

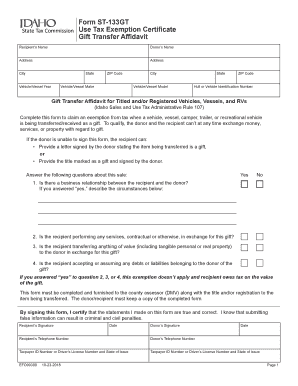

Filling out the Form St 133gt is a crucial step for claiming a tax exemption when receiving a vehicle, vessel, or recreational vehicle as a gift. This guide will provide clear, step-by-step instructions to help you successfully complete the form online.

Follow the steps to fill out Form St 133gt online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering the recipient’s name in the designated field at the top of the form. This is the individual who will receive the gift.

- Next, fill in the donor’s name. This field refers to the individual who is giving the gift.

- Provide the addresses for both the donor and recipient. Fill in each of the address fields, including street address, city, state, and ZIP code.

- Enter the vehicle or vessel year, make, and model in the appropriate sections. This information is crucial for identifying the specific item being transferred.

- Locate the hull or vehicle identification number and input it in the designated field. This number is important for the legal identification of the item.

- Answer the questions regarding the relationship between the donor and recipient. For questions 1 through 4, check 'Yes' or 'No' as appropriate, providing additional details if necessary.

- Review your entries for accuracy, ensuring all required fields are completed correctly.

- Once you have filled out all sections, save the changes. You can then download, print, or share the form as needed.

Complete your documents online today to ensure a smooth filing process.

Related links form

You must pay sales or use tax on the purchase of any motor vehicle, even if you intend to give it as an exempt gift.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.