Loading

Get Form 8736

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 8736 online

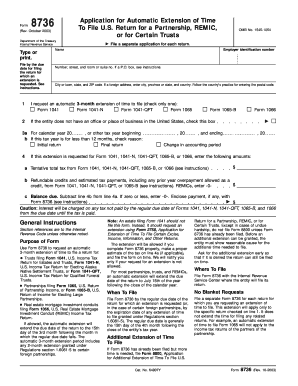

Filling out Form 8736 is essential for those seeking an automatic extension of time to file certain U.S. tax returns for partnerships, real estate mortgage investment conduits, or specific trusts. This guide provides clear, step-by-step instructions to assist you in completing this form online.

Follow the steps to correctly fill out Form 8736 online.

- Select the ‘Get Form’ button to access and open the form in the online editor.

- Complete the first section by entering the name of the entity. Make sure to provide the employer identification number, and include the address details: number, street, room or suite number, city, state, and ZIP code. If it is a foreign address, enter the city, province, or state, and country, following their postal code standards.

- In this step, check the appropriate box to request an automatic 3-month extension for one of the forms listed: Form 1041, Form 1041-N, Form 1041-QFT, Form 1065, Form 1065-B, or Form 1066. Remember, you must file a separate application for each return.

- Indicate the tax year for which the extension is requested. Enter the start and end dates. Specify if your tax year is for less than 12 months by checking the applicable reason, such as initial return, final return, or change in accounting period.

- If applicable, enter the tentative total tax amount expected for the year as indicated on your specific form. List any refundable credits and estimated tax payments on the designated lines.

- Calculate the balance due by subtracting any refundable credits and payments from your tentative total tax. If the result is zero or negative, input -0-.

- Review the entire form for accuracy to ensure that all necessary information is complete. Save your changes, and choose to download, print, or share the completed form as needed.

Complete your Form 8736 online today for a smooth extension process.

Visit www.taxpayeradvocate.irs.gov or call 877-777-4778. Complete this form, and mail or fax it to us within 30 days from the date of this notice. If you use the enclosed envelope, be sure our address shows through the window. If your address has changed, please call 866-xxx-xxxx or visit www.irs.gov.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.