Loading

Get Nzmba

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Nzmba online

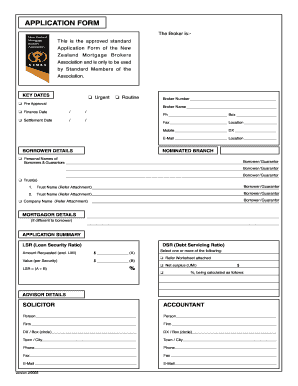

Filling out the Nzmba application form is a straightforward process that ensures you can apply for mortgage finance efficiently. This guide will provide you with comprehensive, step-by-step instructions tailored to your needs, helping you to complete the form accurately and confidently.

Follow the steps to complete your Nzmba application online.

- Click ‘Get Form’ button to access the application form and open it in your preferred editor.

- Begin by entering your broker information, including the broker number and broker name. This section is crucial for identifying your application within the system.

- In the key dates section, select the urgency of your application by choosing either Urgent, Routine, or Pre Approval. Also, enter the desired finance and settlement dates.

- Provide full details of the nominated branch where the application is being processed. Ensure to fill in any contact information required, such as phone number and email.

- Complete the borrower details section. This includes personal names of borrowers and guarantors, as well as any trusts or company names associated with the application.

- Fill out the mortgagor details if they are different from the borrower. This section is important for accurately assessing your application.

- In the application summary area, calculate the Debt Servicing Ratio (DSR) and Loan Security Ratio (LSR) based on the amount requested and the value per security.

- Provide advisor details, including solicitors and accountants who may be involved in your application. Fill out their contact information for easy reference.

- As you continue, enter your personal details, including names, dates of birth, residency status, and other identifying information that will aid in processing your application.

- In the funding details section, outline the security and costs associated with your application, including any mortgages, bank accounts, or properties involved.

- Complete the proposed monthly income and expenditure section with detailed records of your income sources and various expenses to allow for thorough assessment.

- Finish by summarizing your assets and liabilities, making sure to account for all current financial commitments and owned items.

- Review the authority and declaration section, and ensure your signature is included. This section confirms the accuracy of the information provided and authorizes the broker to collect necessary data.

- Finally, save your changes, and choose to download, print, or share the completed Nzmba application form as needed.

Complete your Nzmba application online today to take the next step in your mortgage journey.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.