Loading

Get Fin 530, Property Transfer Tax Return - Ltsa

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the FIN 530, Property Transfer Tax Return - LTSA online

This guide provides comprehensive instructions on how to complete the FIN 530, Property Transfer Tax Return - LTSA online. Whether you are a first-time user or have experience with tax forms, this guide will help you navigate the necessary fields with confidence.

Follow the steps to fill out the FIN 530 online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

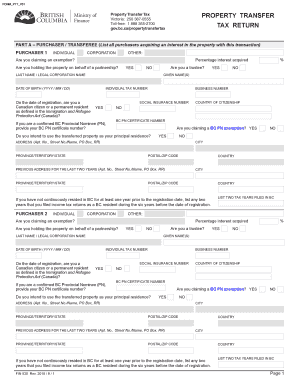

- Begin with Part A, where you will provide information about the purchaser or transferee. This section requires details such as names, individual tax numbers, and addresses. If there are multiple purchasers, ensure you list them correctly.

- Next, move to Part B to fill out the contact name and mailing address if it differs from Part A. Make sure this information is current to avoid any communication issues.

- Proceed to Part C to provide vendor or transferor information. Here, confirm their residency status and include their details similarly to how you did for the purchaser.

- In Part D, describe the property and transfer details, including the date of transaction and legal description. Accurate property descriptions are crucial for the transfer process.

- In Part E, complete the terms of the transaction, including the gross purchase price. This total must include all forms of payment and consideration involved.

- Move to Part G for additional information related to the property or transfer, ensuring all relevant details are included.

- If applicable, fill out Part H and I regarding proportional principal residence information and property transfer tax calculation respectively.

- Complete Part J, authorizing payment transfers. Ensure all required signatures are present and up-to-date.

- Finally, review all filled sections for accuracy, then save changes, download a copy, or print the form for submission.

Complete your FIN 530, Property Transfer Tax Return - LTSA online today to ensure a smooth and efficient process.

The exemptions include, but are not limited to: certain transfers between spouses. certain transfers from an individual to his or her family business corporation. certain transfers of farmed land between family members.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.