Loading

Get Roth Ira Simplifier

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Roth IRA Simplifier online

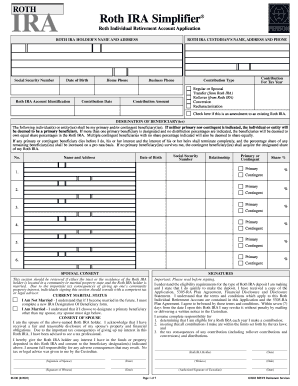

The Roth IRA Simplifier is an essential document for individuals looking to establish a Roth Individual Retirement Account. This guide provides clear and supportive instructions for filling out the form, ensuring users can navigate the process with ease.

Follow the steps to accurately complete the Roth IRA Simplifier.

- Press the ‘Get Form’ button to retrieve the Roth IRA Simplifier and open it for editing.

- Begin with the Roth IRA holder’s name and address. Ensure that the name matches your official documents and input your current residential address.

- Next, provide your Social Security number and date of birth. This information is crucial for identity verification and must be accurately entered.

- Identify your Roth IRA account by including the account identification number if applicable. If this is your first account, this section can typically be left blank.

- Fill in the Roth IRA custodian’s name, address, and contact details. This refers to the financial institution or entity managing your account.

- Provide your home and business phone numbers to facilitate communication regarding the account.

- Indicate the contribution date and specify the tax year for your contributions. This ensures that your contributions are allocated correctly for tax purposes.

- Select the type of contribution you are making, whether it is a regular or spousal contribution, transfer, rollover, conversion, or recharacterization.

- Enter the contribution amount you wish to make. Ensure this aligns with IRS limits to avoid penalties.

- If this is an amendment to an existing Roth IRA, check the indicated box to inform the custodian.

- Designate your beneficiaries by filling in their names, addresses, dates of birth, Social Security numbers, relationships, and share percentages. Ensure clarity on who is primary and who is contingent.

- Complete the spousal consent section if applicable. This is important in community property states and for tax implications.

- Review and sign the form, ensuring your signature and date are included. If a spouse needs to consent, they must also sign the document.

- Finally, ensure all steps are correct, save your changes, and download a copy of the completed form. You may also choose to print or share it as necessary.

Complete your Roth IRA Simplifier online today and secure your retirement savings.

You can withdraw Roth IRA contributions at any time with no tax or penalty. If you withdraw earnings from a Roth IRA, you may owe income tax and a 10% penalty. If you take an early withdrawal from a traditional IRA whether it's your contributions or earnings it may trigger income taxes and a 10% penalty.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.