Loading

Get On428 Worksheet

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the On428 Worksheet online

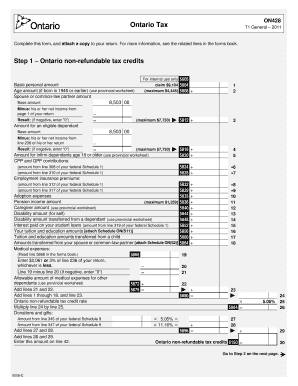

Filling out the On428 Worksheet is an important step in reporting your Ontario tax credits and calculating your tax obligations. This guide provides clear, step-by-step instructions to help users navigate the online process effectively.

Follow the steps to complete the On428 Worksheet accurately.

- Click ‘Get Form’ button to access the On428 Worksheet and open it in your browser.

- Begin with section for Ontario non-refundable tax credits. Enter your base amount, subtracting any net income from your return. Follow the prompts for each specific credit, like basic personal amount, age amount, spouse or partner amount.

- Proceed to calculate contributions for CPP, QPP, and employment insurance premiums using amounts from your federal Schedule forms.

- Input medical expenses, following guidance to determine the allowable amount based on your personal situation.

- Complete the section pertaining to donations and gifts, ensuring all related amounts are accurately summed.

- Move on to the Ontario tax on taxable income, entering the appropriate figures based on your income levels outlined in previous sections.

- Continue with Ontario tax reduction if applicable, providing any dependent information where required.

- Fill out foreign tax credits and labour sponsored investment fund tax credits, if relevant.

- Finalize your entry by calculating the Ontario Health Premium based on your taxable income, entering the determined amount.

- Once all sections are completed, save your changes, download, print, or share the completed On428 Worksheet as needed.

Complete your On428 Worksheet online today to ensure accurate tax reporting and maximize your credits.

Related links form

The basic personal amount (BPA) is a non-refundable tax credit that can be claimed by all individuals. The purpose of the BPA is to provide a full reduction from federal income tax to all individuals with taxable income below the BPA. It also provides a partial reduction to taxpayers with taxable income above the BPA.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.