Loading

Get Disclosure Statement On Loan Credit Transaction

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Disclosure Statement On Loan Credit Transaction online

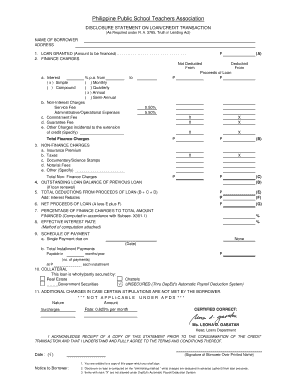

The Disclosure Statement On Loan Credit Transaction is a crucial document that outlines the terms and details of a loan. Completing this form accurately will help ensure clarity and transparency in your loan agreement.

Follow the steps to complete the form online successfully.

- Press the ‘Get Form’ button to access the document and open it in your preferred online editor.

- Begin by entering the name of the borrower in the designated field. Ensure this is a complete and accurate representation of the individual who is taking out the loan.

- Next, input the address of the borrower. This should include the full street address, city, and state for proper identification.

- In the loan granted section, state the amount to be financed. Write this amount in Philippine pesos (P).

- Proceed to the finance charges section. Indicate whether these charges are deducted from the proceeds of the loan. Specify the interest rate and the method of calculation (simple, monthly, compound, etc.).

- For non-interest charges, fill in the details for any applicable services, taxes, or fees. Clearly specify any other charges that may apply.

- If this is a renewal loan, record the outstanding loan balance from any previous loan.

- Calculate the total deductions from the proceeds of the loan and enter it in the corresponding section. Include interest rebates if applicable.

- Calculate the net proceeds of the loan by subtracting the total deductions from the loan amount and adding any rebates.

- In the section about finance charges as a percentage of the total amount financed, calculate and input the corresponding percentage.

- Next, detail the effective interest rate based on the attached computation method.

- Fill out the payment schedule, including whether there is a single payment or multiple installment payments, and specify the total payments due.

- Identify any collateral securing the loan. Mark the appropriate options for real estate, government securities, or unsecured status.

- Complete the additional charges section, if applicable, providing details regarding any potential surcharges that may arise if the conditions of the loan are not met.

- Finally, ensure you sign and date the form where indicated, acknowledging that you have received and understood the disclosure statement.

- Once you have completed the form, save your changes. You may then download, print, or share the completed document as needed.

Complete your documents online today for a seamless agreement process.

The purpose of a disclosure statement is to provide explanatory information regarding the significant features of the insurance policy to enable the insured to make an informed decision regarding purchasing the insurance policy.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.