Loading

Get Form It 360 1

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form IT-360.1 online

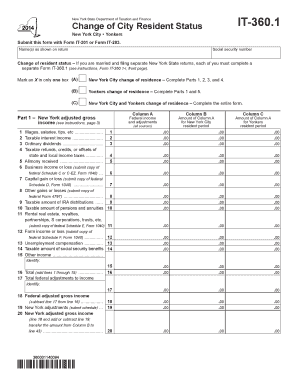

Filling out the Form IT-360.1 is essential for individuals changing their residency status within New York City or Yonkers. This guide will provide you with a clear, step-by-step process to help you successfully navigate the online completion of the form.

Follow the steps to accurately complete the Form IT-360.1 online.

- Click the ‘Get Form’ button to access the form and open it in your browser.

- Provide your name(s) exactly as they appear on your tax return in the designated field.

- Enter your Social Security number in the appropriate section. Ensure this is accurate as it is critical for identification purposes.

- Indicate your change of resident status by marking an X in the appropriate box (A for New York City, B for Yonkers, or C for both).

- Complete Part 1 by entering your New York adjusted gross income details into the provided fields (lines 1-15), ensuring to submit required schedules for specific income sources as indicated.

- Move to Part 2 if applicable, and enter any itemized deductions you claim as a New York City resident. If claiming a standard deduction, skip this part.

- In Part 3, fill out details concerning dependent exemptions, including the duration of your residency and the number of exemptions claimed.

- Proceed to Part 4 and calculate your New York City resident tax based on your adjusted gross income and applicable deductions.

- Finally, if you are a part-year Yonkers resident, enter the necessary details in Part 5. After all sections are completed, review the information for accuracy.

- At the end of the process, save your changes, then download or print the completed form for submission.

Complete your Form IT-360.1 online today to ensure your residency status is updated accurately.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

STATE PROCESSING CENTER, 575 BOICES LANE, KINGSTON NY 12401-1083.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.