Loading

Get Business Interruption Calculation Sheet

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Business Interruption Calculation Sheet online

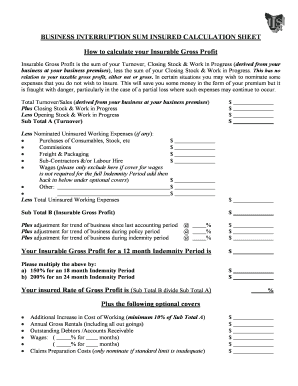

The Business Interruption Calculation Sheet is an essential tool for determining your insurable gross profit in the event of a business disruption. This guide provides clear, step-by-step instructions to help you accurately complete the form online, ensuring that you capture all necessary information for your insurance needs.

Follow the steps to successfully complete the Business Interruption Calculation Sheet

- Click ‘Get Form’ button to obtain the Business Interruption Calculation Sheet and open it for editing.

- Begin by entering your Total Turnover/Sales, which is the revenue generated from your business at your business premises.

- Next, input your Closing Stock & Work in Progress into the specified fields.

- Then, enter your Opening Stock & Work in Progress. After these entries, calculate Sub Total A by adding Total Turnover/Sales and Closing Stock & Work in Progress, then subtract the Opening Stock & Work in Progress.

- If applicable, list any Nominated Uninsured Working Expenses in the designated section. This includes expenses such as purchases of consumables, stock, commissions, and wages.

- Calculate the Total Uninsured Working Expenses by summing the nominated expenses and subtract this total from Sub Total A to arrive at Sub Total B, which represents your Insurable Gross Profit.

- Proceed to enter any necessary adjustments for the trend of business, both since the last accounting period and during the policy period. Ensure that you document these adjustments in the respective fields.

- Once you have completed your adjustments, your Insurable Gross Profit for a 12 month Indemnity Period will be visible. Multiply this figure accordingly if you need to extend to 18 or 24 month Indemnity Periods.

- Calculate your insured Rate of Gross Profit by dividing Sub Total B by Sub Total A.

- Lastly, review the section for optional covers and enter any additional costs that may apply to your situation, such as additional costs of working or outstanding debtors.

- After verifying all entries are accurate, save any changes, and download, print, or share the completed form as necessary.

Start filling out your Business Interruption Calculation Sheet online today.

Business Income Worksheet a form used to estimate an organization's annual business income for the upcoming 12-month period, for purposes of selecting a business income limit of insurance. ... For some organizations, this period could exceed 12 months.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.