Loading

Get Nm Pit 1

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Nm Pit 1 online

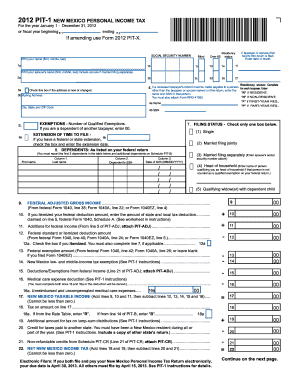

Filling out the Nm Pit 1 form online is a straightforward process designed to help you accurately report your personal income tax for New Mexico. This guide will provide clear, step-by-step instructions for each section of the form to ensure you complete it effectively.

Follow the steps to successfully complete the Nm Pit 1 online.

- Click ‘Get Form’ button to access the online version of the Nm Pit 1 form and open it in the appropriate document editor.

- Begin by entering your Social Security Number in the designated field. This is essential for identification.

- Next, print your name as it appears on your identification (first, middle, last). Optionally, indicate if you are blind or over 65 years of age by marking the appropriate boxes.

- Indicate your residency status by checking the relevant box. Provide the required details if married, including your spouse's name and Social Security Number if applicable.

- If applicable, complete the section for dependents by entering their names, Social Security Numbers, and dates of birth. Ensure you check the residency status for each dependent.

- Fill in your exemptions by calculating the number of qualified exemptions you have and indicating your filing status by marking the appropriate box.

- Proceed to input your federal adjusted gross income, deductions, and any additional income adjustments as necessary, ensuring you refer to the corresponding federal form lines as indicated.

- Continue by detailing your tax credits and payments, making sure to calculate the total accurately based on the form's instructions.

- Review all entered information for accuracy before proceeding to the final section.

- Complete the section regarding any refund or tax due. If you prefer direct deposit, provide your banking details as requested.

- Finish by signing the form and inputting the date, as required. If filing jointly, ensure both parties sign the form.

- Once all sections are completed and reviewed, save your changes and choose an option to download, print, or share the completed form based on your needs.

Start filling out the Nm Pit 1 online today to ensure you meet the filing deadlines.

New Mexico's law says every person who has income from New Mexico sources and who is required to file a federal income tax return must file a personal income tax return in New Mexico. You must also file a New Mexico return if you want to claim: a refund of New Mexico state income tax withheld from your pay, or.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.