Loading

Get Small Business Registration Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Small Business Registration Form online

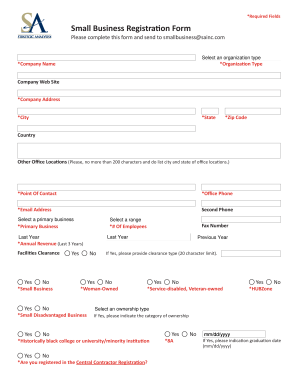

Filling out the Small Business Registration Form online is a straightforward process that can help you establish your business registration efficiently. This guide offers a step-by-step approach to ensure you understand each section and can complete the form accurately.

Follow the steps to complete the form successfully.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by selecting your organization type from the provided options. Ensure that you choose the correct category as it will affect your registration status.

- Enter your company name in the designated field. This should be the legal name under which your business operates.

- Complete the company address section by providing your official business location, including the city, state, and zip code.

- Input your point of contact information, which includes the name, office phone, and email address of the individual responsible for communications.

- Select your primary business type and the range of services you provide. Additionally, indicate the number of employees your business has.

- Provide your company’s annual revenue for the last three years in the respective fields and answer questions regarding facilities clearance and small business status.

- If applicable, indicate if you are a woman-owned business, small disadvantaged business, or service-disabled veteran-owned business.

- List your core competencies, ensuring it is concise and relevant, as this will be used for key searches.

- Fill in the North American Industry Classification System (NAICS) codes as needed and list any federal government contracting vehicles you hold.

- If you have previously done business with Strategic Analysis, provide relevant details and list any commercial customers.

- Review all entered information for accuracy before completing the form. Once verified, save changes, download, print, or share the form as necessary.

Start your business registration process today by completing the Small Business Registration Form online.

Apply for an Employer Identification Number (EIN) if applicable. Select a business structure. Choose a tax year. If you have employees have them fill out Form I-9 PDF (PDF) and Form W-4. Pay your business taxes.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.