Loading

Get Sts 20002 A

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Sts 20002 A online

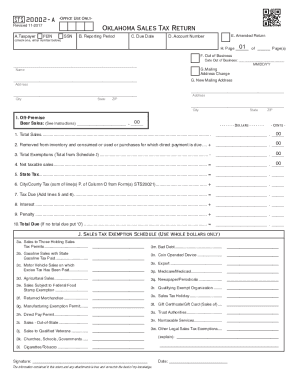

Filling out the Sts 20002 A online can seem daunting, but it is a straightforward process when approached step-by-step. This guide aims to assist users in accurately completing the Oklahoma Sales Tax Return for filing returns after July 1, 2017.

Follow the steps to complete the Sts 20002 A smoothly.

- Click 'Get Form' button to obtain the form and open it in the editor for completion.

- In section A, verify or enter your taxpayer identification number, choosing either the Federal Employer Identification Number (FEIN) or Social Security Number (SSN) as applicable.

- In section B, input the reporting period for which you are filing. This should reflect the month and year of the sales being reported.

- In section C, enter the due date for the return. This date is critical as it indicates when your submission must be postmarked.

- In section D, make sure to input your account number accurately for correct processing.

- If you are submitting an amended return, check box E accordingly.

- Should this be your final sales tax return, indicate this by checking box F and providing the date you ceased operations.

- If your mailing address has changed, check box G and input the new address details.

- Move to section H and enter the total number of pages you are submitting as part of this filing.

- Section I is informative only. Enter the total for low point off-premises beer sales if applicable, but remember this is not a deductible amount.

- Proceed to line 1 and enter the total sales amount, including all gross receipts, taxable, and non-taxable.

- On line 2, document the sales value of items removed from inventory for consumption or use during this period.

- Complete line 3 using the exemption schedule provided in Item J, summarizing total sales tax exemptions.

- Calculate your net taxable sales by subtracting line 3 from the total of lines 1 and 2, documenting this amount on line 4.

- On line 5, calculate the state tax by multiplying the amount on line 4 by the applicable tax rate.

- Line 6 requires you to add city/county tax due from applicable schedules.

- For line 7, sum the amounts from lines 5 and 6 for your total tax due.

- If filing late, calculate interest on line 8 as specified in the instructions, then note this amount.

- If applicable, compute a penalty on line 9 for late filing as per the guideline noted in the instructions.

- Finally, total the return by adding lines 7, 8, and 9 to complete line 10.

- Sign and date the return and prepare to mail it alongside your payment to the Oklahoma Tax Commission.

Complete your Sts 20002 A online today to ensure timely processing!

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.