Loading

Get Anti-churning Disclosure - Hud

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Anti-Churning Disclosure - HUD online

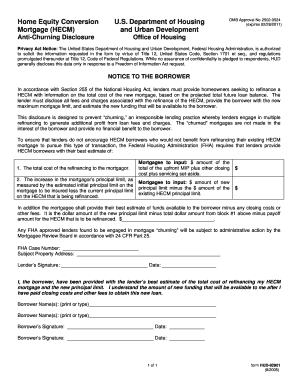

The Anti-Churning Disclosure form by HUD is a vital document for homeowners looking to refinance their Home Equity Conversion Mortgage (HECM). This guide will provide you with clear and supportive instructions on how to fill out this form properly online.

Follow the steps to complete the Anti-Churning Disclosure - HUD.

- Click ‘Get Form’ button to access the Anti-Churning Disclosure form and open it in your preferred online editor.

- Begin by entering the FHA Case Number in the designated field. Ensure this number corresponds to the specific HECM you are refinancing.

- Next, input the subject property address. Be sure to include all necessary details to ensure accuracy.

- In the section provided for the total cost of refinancing, enter the amount that reflects the total of the upfront mortgage insurance premium (MIP), closing costs, and servicing set-aside.

- For the next component, calculate and enter the estimated increase in the mortgagor’s principal limit. This is determined by subtracting the current principal limit of the existing HECM from the new estimated initial principal limit.

- Then, provide the best estimate of funds available to the borrower after subtracting any closing costs or fees. This value should be calculated as the new principal limit minus the total costs entered in step 4 and the payoff amount for the HECM being refinanced.

- After completing the financial sections, the lender must sign and date the form in the designated area to validate the information provided.

- As the borrower, review and print your name clearly in the provided fields, ensuring all names are printed or typed accurately.

- Finally, the borrower must sign and date the form in the specified areas, confirming their understanding of the costs and new funding associated with the refinancing.

- Once all fields are filled and verified for accuracy, save the changes, and proceed to download, print, or share the completed form as needed.

Complete your Anti-Churning Disclosure form online today to ensure a smooth refinancing process!

You might provide copies of your W2s, paycheck stubs, a Social Security award letter, or statements from your bank or the administrators of your retirement accounts. If you don't have enough income to pay property taxes and homeowners insurance, you still might be eligible for a reverse mortgage loan.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.