Loading

Get Federal Employer Identification Number (fein) Or Social Security Number:

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Federal Employer Identification Number (FEIN) or Social Security Number: online

Filling out the Federal Employer Identification Number (FEIN) or Social Security Number form online is an important task that requires careful attention to detail. This guide will help you navigate the process, ensuring you complete the form accurately and efficiently.

Follow the steps to complete the FEIN or Social Security Number form online.

- Click ‘Get Form’ button to obtain the form and open it in your browser.

- Fill in the legal name and doing business as sections. Ensure that the names provided match your registered business records.

- Enter your Federal Employer Identification Number (FEIN) or Social Security Number in the designated field. If you are a sole proprietor without a FEIN, you can use your Social Security Number.

- If applicable, indicate whether you are a pass-through entity by checking the appropriate box. Provide the pass-through FEIN and the tax period ending date if necessary.

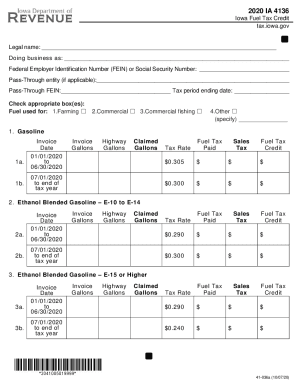

- Indicate the fuel used by checking the appropriate box or boxes for farming, commercial use, commercial fishing, or other. Be sure to specify if you select 'Other.'

- For each fuel type, fill in the corresponding invoice details including dates, invoice gallons, highway gallons, claimed gallons, fuel tax paid, sales tax, and fuel tax credit. Ensure the calculations are accurate.

- Complete any additional sections as requested based on the fuel types used and claimed under the tax credit.

- After filling out all the necessary fields, review your entries for accuracy and completeness.

- Save your changes, download the completed form, print it for your records, or share it as needed.

Complete your Federal Employer Identification Number (FEIN) or Social Security Number form online today!

You can locate your EIN on your confirmation letter from the IRS, old tax returns, old business loan applications, your business credit report, or payroll paperwork. You can also call the IRS to look up your federal tax ID number. If you need to locate another company's EIN, you can start by asking the company.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.